MIGRATION OF EXISTING TAXPAYERS IN GST

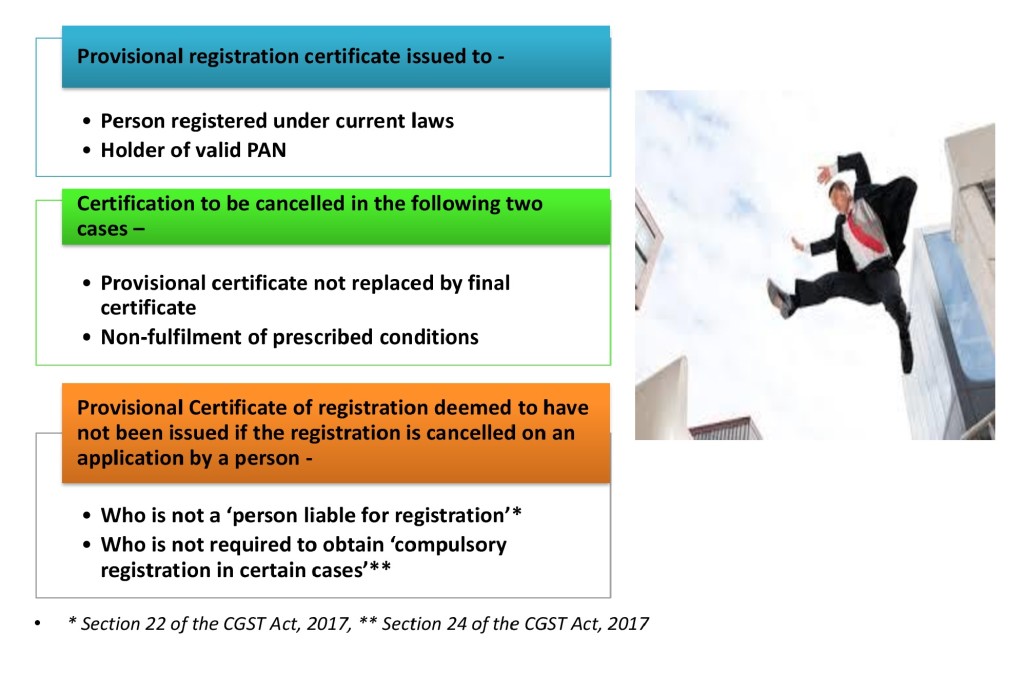

- A certificate of registration on a provisional basis is first issued to every person registered under earlier law, and such certificate shall be valid for six months from the date of the issue. This may be extended for such a period as the central/state governments may specify.

- It further provides that every such person to whom a certificate of registration has been issued will be required to furnish such information as may be prescribed, and on doing so, the provisional certificate granted under section 142(1) shall be granted on a final basis by the Central/State Government.

- Any provisional registration granted under this section may be cancelled if such person fails to furnish the prescribed information within such time as may be specified.

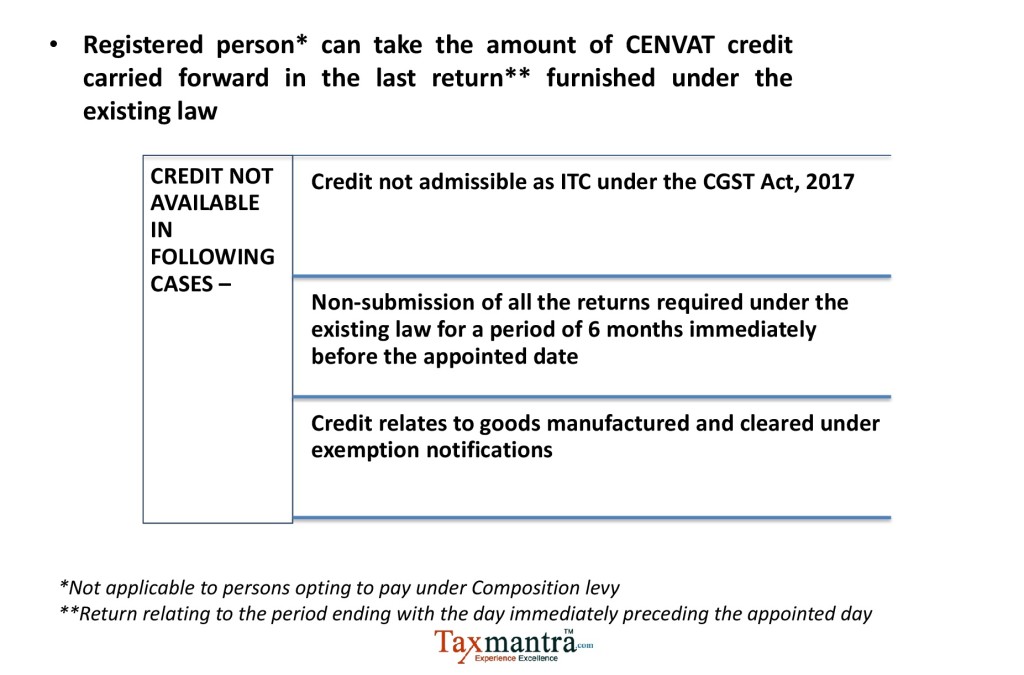

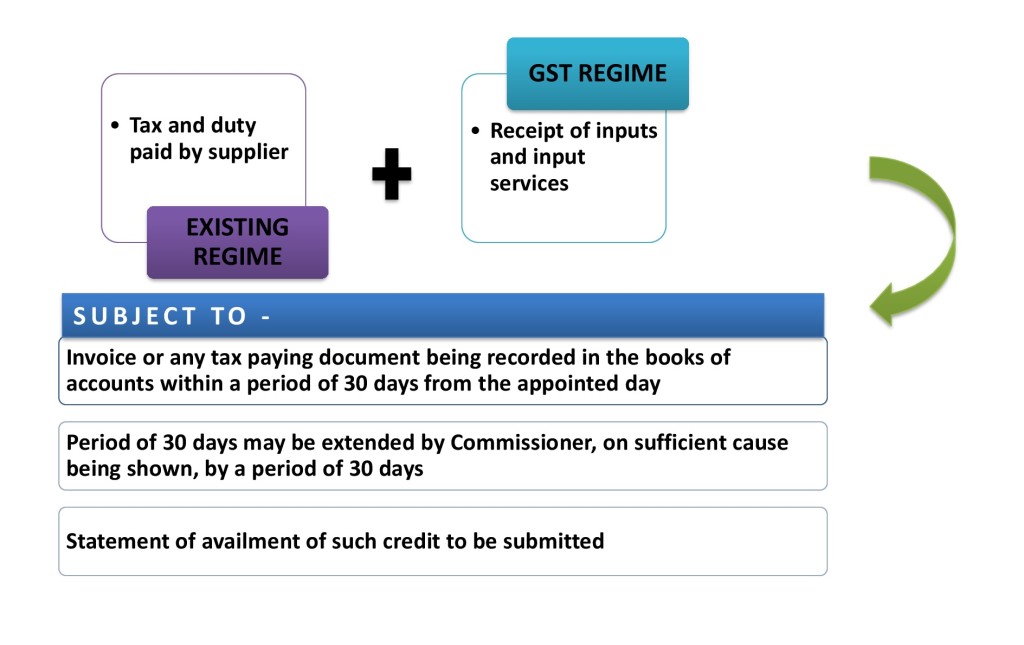

Amount of CENVAT Credit carried forward in a return to be allowed as input tax credit

(CGST LAW)

- This section provides that a registered taxable person shall be entitled to take, in his electronic ledger, credit of the CENVAT credit carried forward in a return, furnished under earlier law by him, in respect of the period ending with the day immediately preceding the appointed in the manner prescribed.

- It further provides that the amount taken as credit above, shall be recovered as arrear of tax under this Act from the taxable person if the said amount is found to recoverable as a result of any proceeding instituted before or after such person.

(SGST LAW)

- A registered taxable person under SGST law shall be allowed to take credit in his electronic ledger of the credit of the amount of value added tax carried forward in a return furnished under the earlier law provided the credit proposed to be carried forward is admissible under the earlier as well as the proposed law. Provisions of recovery under the CGST law apply mutatis mutandis to the proposed SGST law.

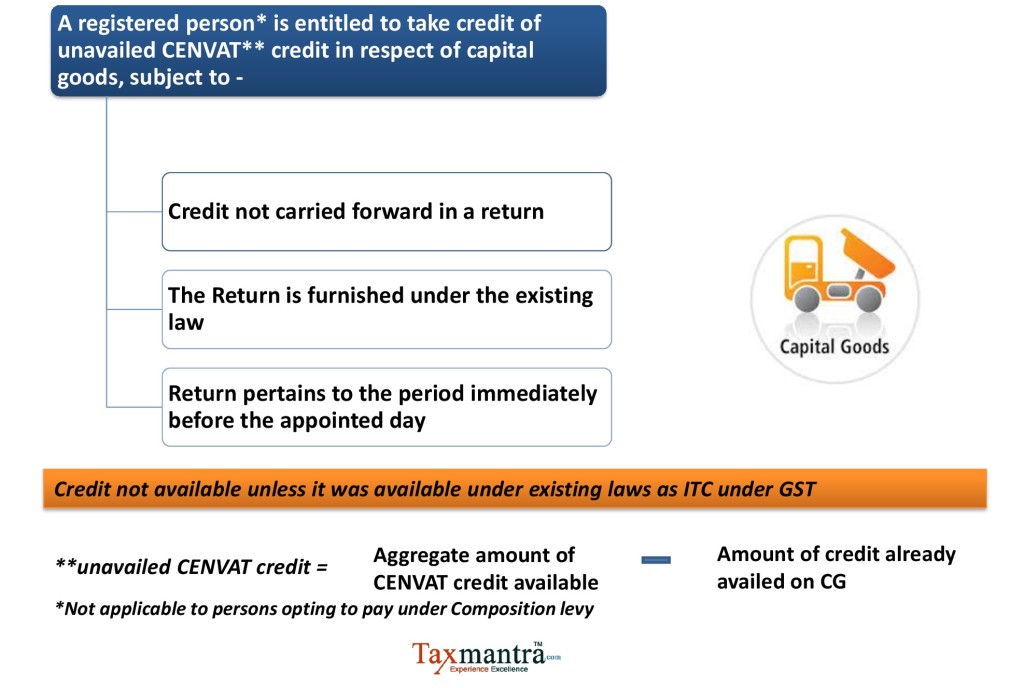

CENVAT Credit on Capital goods

- A registered taxable person shall be entitled to take in, in his electronic ledger, credit of the unavailed cenvat credit in respect of capital goods, not carried forward in a return furnished under the law in a prescribed manner. This, however, is subject to the condition that the credit shall be allowed when such credit was admissible as cenvat credit and is admissible as input tax credit under this Act.

- The amount taken as credit under this provision shall be recovered as an area of tax from the taxable person if the said amount is found to be recoverable as a result of any proceeding instituted before or after the appointed day against such person under the earlier law.

- The above mechanism applicable for availing credit of unavailed credit in respect of capital goods under the CGST law shall also apply mutatis mutandis for the credit of capital goods under SGST law.

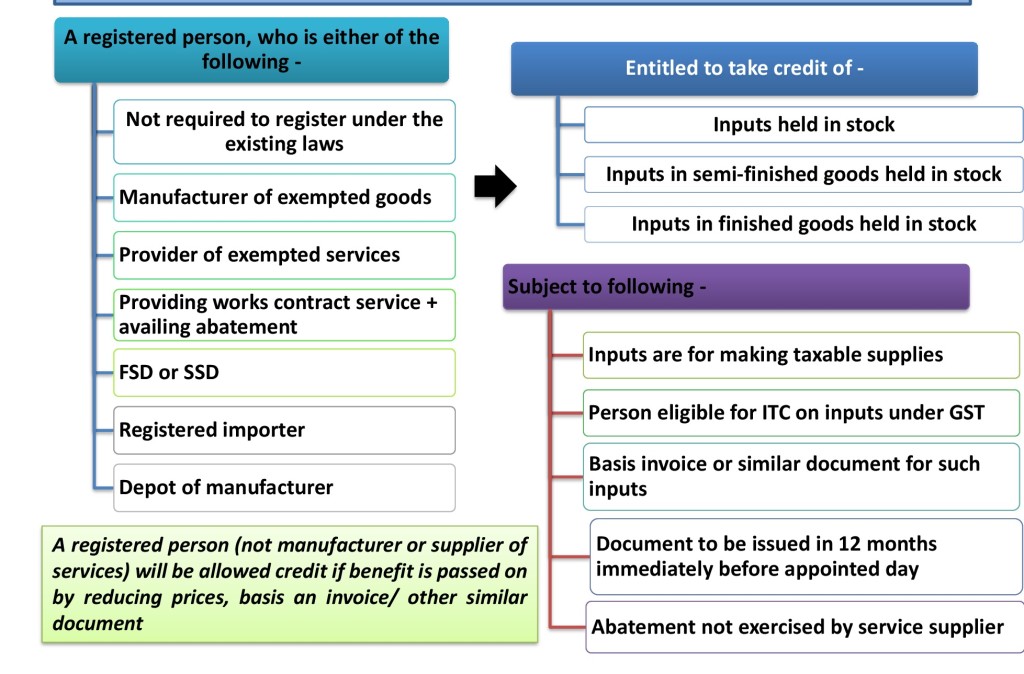

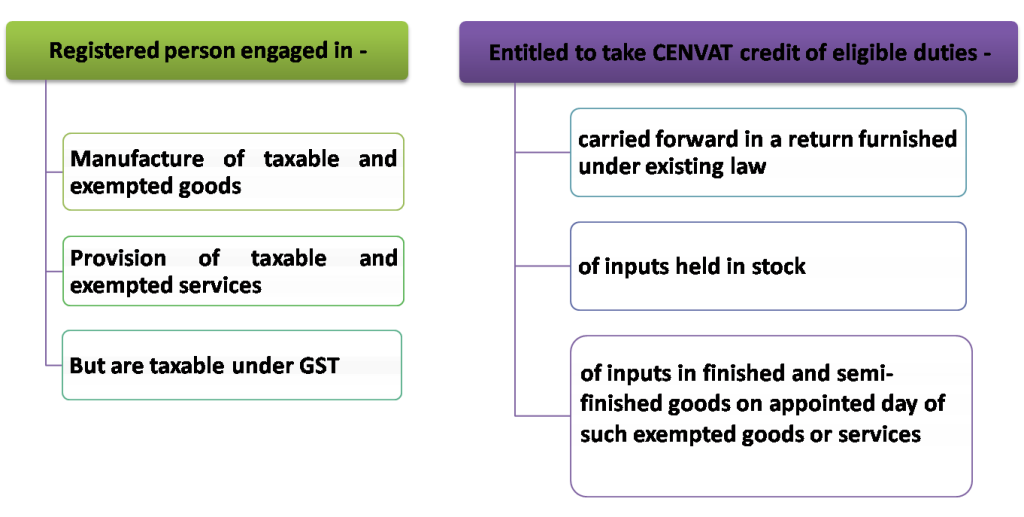

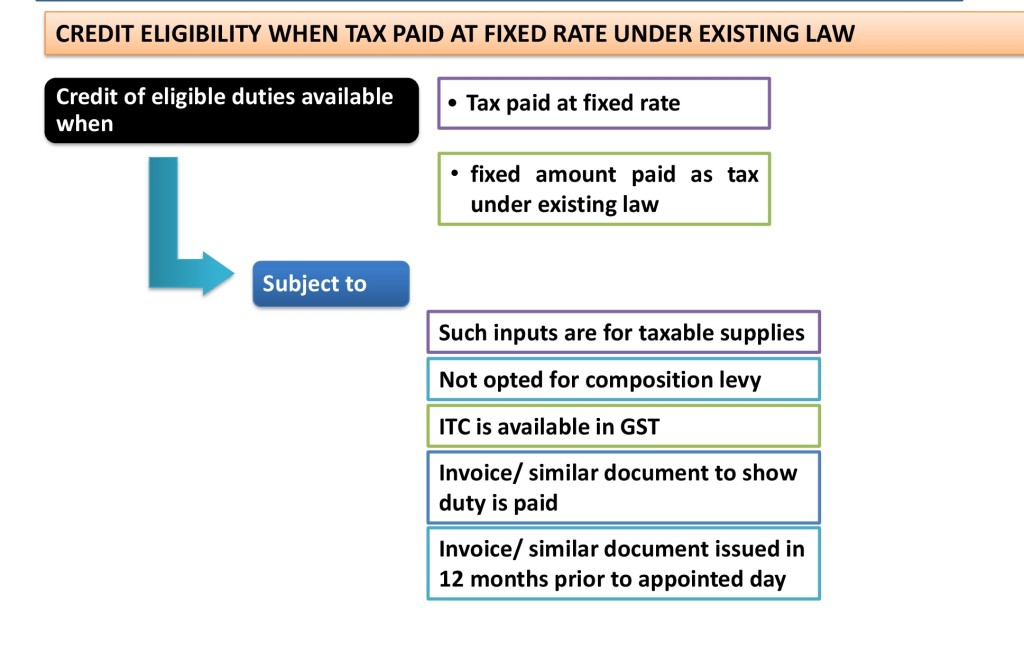

Credit of “eligible duties and taxes” in respect of inputs held in stock

CGST LAW

- This provision allows a registered taxable person,

- who was not liable to be registered under the earlier law or

- who was engaged in the manufacture of exempted goods under the earlier law but which are liable to tax under this Act,

- to take, in his electronic ledger, credit of eligible duties and taxes

- in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock,

- subject to several conditions like:

–such inputs/goods are used or intended to be used for making taxable supplies under this Act, and

–such taxable person was eligible for cenvat credit on receipt of such inputs and/or goods under the earlier law but for his not being liable for registration or the goods remaining exempt under the said law

–Invoice of goods is available

–Invoice date is not earlier than 12 months preceding the appointed day

SGST LAW

- These provisions apply mutatis mutandis to credit of VAT under the State VAT laws

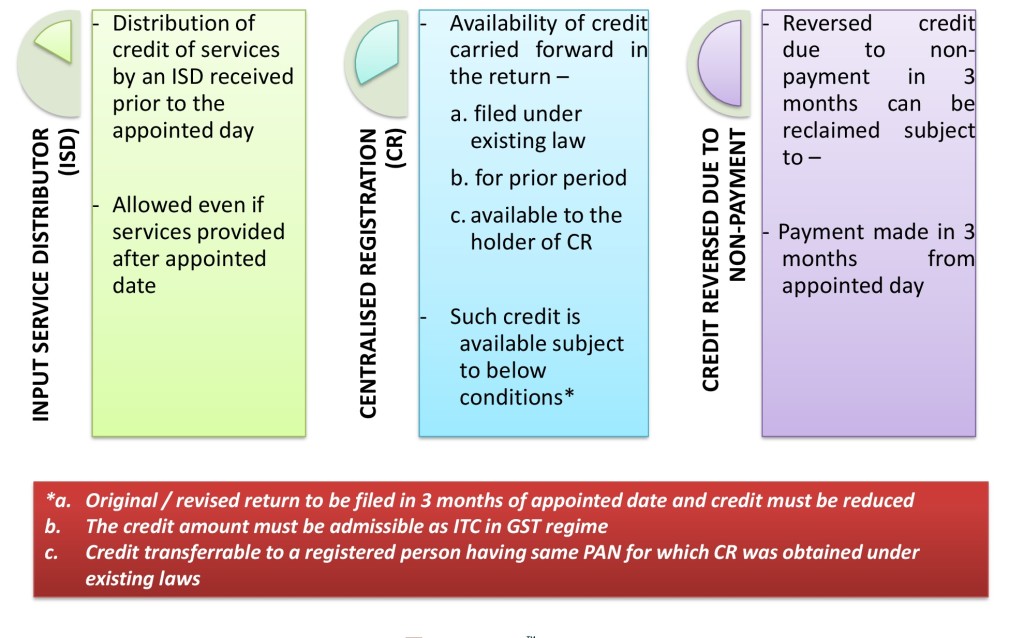

TRANSITIONAL ARRANGEMENTS FOR ITC

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us