Direct Taxes (including International Taxation)

CBDT extends FY19 income tax return filing deadline till September 30

Direct Taxes (including International Taxation) | By Editor | Jul 30, 2020

The government on Wednesday extended the deadline for filing income tax returns for 2018-19 fiscal by two months till September 30. ̶...

Govt starts e-campaign on Voluntary Income Tax Compliance for tax payers

Direct Taxes (including International Taxation) | By Editor | Jul 21, 2020

The Income Tax Department is all set to start an e-Campaign on voluntary compliance of Income Tax for the convenience of the taxpayers fr...

Income Tax Return For FY 2019-20 For Non-Resident Individuals (NRIs) – An FAQ

Direct Taxes (including International Taxation) | By Manish Soni | Jul 10, 2020

How to determine residential status in India? If a person satisfies any of the two conditions mentioned below then he/she i...

Income Tax Return for FY 19-20 can now be filed till November 30

Direct Taxes (including International Taxation) | By Editor | Jun 25, 2020

In a major compliance relief for taxpayers impacted by the disruptions due to COVID-19, the Central Board of Direct Taxes (CBDT) has furt...

5 key takeaways from what RBI governor said today

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | May 22, 2020

RBI Governor’s 3rd Press Meeting during Covid-19 Pandemic in Last 2 months has covered variety of topics ranging from extension of EMI mo...

Case Study- How to hold EGM during Lockdown

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | May 14, 2020

Case Study – Founders of Startup Pvt Ltd a Bangalore based Entity has finalized the Term Sheet with an investor who wishes to inves...

Support for Migrant workers and Farmers, CLSS gets extended: Atmanirbhar Bharat Abhiyaan Part 2

COVID-19 Resources | By Editor | May 14, 2020

Finance Minister Nirmala Sitharaman on Thursday (May 14) announced the second set of measures that are part of a Rs 20 lakh crore economi...

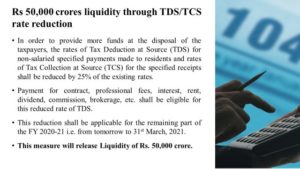

TDS, TCS reduced by 25% – Atmanirbhar Bharat Abhiyaan Part 1

COVID-19 Resources | By Editor | May 14, 2020

The Central Board of Income Tax on Wednesday ordered a 25% reduction in the rate of income tax deducted at source (TDS) and tax collectio...

Businesses should know these changes in Income Tax Rules w.e.f April 2020

Direct Taxes (including International Taxation) | By Editor | May 11, 2020

In the wake of the countrywide lockdown for dealing with the global COVID crisis, India’s Parliament, just before adjourning, enacted the...

Things to note while finalizing the books of accounts

CFO Advisory Services | By Editor | May 11, 2020

In these turbulent times, it is very difficult to focus on all aspects of business. Let us worry about the compliance matters so t...

How to change the financial year of Singapore Company

CFO Advisory Services | By Soumik Kumar Sen | May 8, 2020

The financial year as per Singapore Laws is generally of 12 months( extendable upto 18 months in the first year after the incorporation o...

Form 15G and 15H can now be furnished for claiming exemption from tax on dividend too

Direct Taxes (including International Taxation) | By ALOK PATNIA | Apr 24, 2020

From April 1, 2020, dividend received on shares of a domestic company and/or from mutual fund schemes is taxable in the hands of an indiv...

Toll Free:

Toll Free:  Contact Us

Contact Us