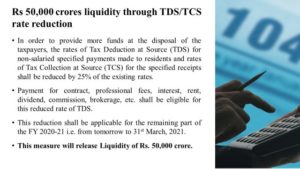

The Central Board of Income Tax on Wednesday ordered a 25% reduction in the rate of income tax deducted at source (TDS) and tax collection at source (TCS) from 14 May to 31 March to provide more money in the hands of taxpayers.

The Central Board of Income Tax on Wednesday ordered a 25% reduction in the rate of income tax deducted at source (TDS) and tax collection at source (TCS) from 14 May to 31 March to provide more money in the hands of taxpayers.

This concession is applicable for 23 specified payments where TDS is levied at rates ranging between 20% and 1% and 11 payments where TCS is applicable.

Know more: Key highlights from Nirmala Sitharaman’s Press Conference – Atmanirbhar Bharat Abhiyaan

Here are some points that you should know:

- This reduced rate of TDS will apply to the specified list of payments including dividend, payment to contractors and sub-contractors, insurance commission, brokerage, rent for machinery and immovable property and professional fee. Here is the comprehensive table of existing and new reduced rates issued by the Income Tax department.

List can be accessed here: TDS reduced Rate List

2. The banks will also pass the benefits to customers. According to the income tax department, if someone is to receive bank interest of Rs 20,000, then at the existing rate of 10% the bank would have deducted TDS of Rs 2,000. Since the new rate of TDS would be 7.5%, the bank will be required to deduct only Rs 1,500. So person will get an extra liquidity of Rs. 500.

3. This relaxation only applies to payment made between 14 May 2020 and 31 March 2021. So this will not cover payments made before 14 May 2020.

4. This does not really reduce the Income Tax liability. The individual shall eventually have to pay the tax at the applicable rate, depending on the income. Those who are liable for advance tax will have to make the payment every quarter. Others will have to pay when filing income tax returns.

5. There shall be no reduction in rates of TDS or TCS for those who do not furnish PAN/Aadhaar.

So if the tax is required to be deducted at 20% due to non-furnishing of PAN or Aadhaar, it shall be deducted at the rate of 20% and not at the rate of 15%.

__________________________________________________________________________________________________________

We’re listening:

For any query, support or feedback, reach us at India Tax & Legal Compliance or WA us at +91-9230033070 or Call us at 1800-102-7550 for any support/query/feedback.

In these troubled times -COVID-19, we, at Taxmantra Global urge you to stay safe – social distancing, personal hygiene and health care are of utmost importance! Stay safe!

__________________________________________________________________________________________________________

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us