GST & Other Indirect Taxes

Administrative jurisdiction no bar for launching GST enforcement action

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 10, 2018

To expedite action against erring taxpayers under GST, the Central Board of Indirect Taxes and Customs (CBIC) has written to field format...

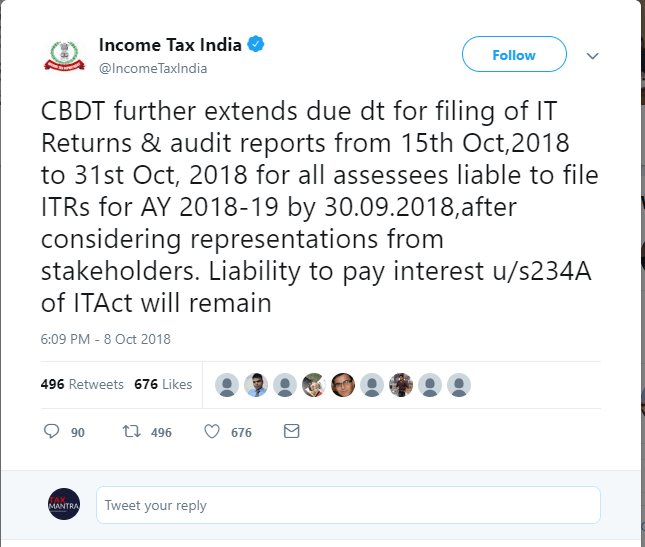

Income Tax Return filing due date extended to October 31st 2018

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 8, 2018

The Central Government today extended the due date for Tax Audit and return filing under the provisions of Income Tax Act to October 31st...

GST policy on e-commerce may make life difficult for cab startups

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 8, 2018

A Bengaluru-based startup has filed an appeal questioning a July 27 ruling by GST authorities in Karnataka which said app-based cab aggre...

World Bank says that Indian economy has recovered from disruptions of demonetization and GST, gro...

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 8, 2018

Growth in India is firming up and projected to accelerate to 7.3% in the 2018-19 fiscal and 7.5% in the next two years, the World Bank sa...

Fuel under GST to affect states’ revenue: Chief Ministers

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 8, 2018

Opposing the idea of bringing fuel products under the Goods and Services Tax (GST), three Chief Ministers from different political partie...

Travel portals seek clarity on TCS provision under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 5, 2018

India’s online travel providers such as MakeMyTrip, Yatra, Cleartrip and others are in a quandary over the new tax collected at source (T...

Supreme Court upholds GST compensation tax as constitutionally valid

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 5, 2018

The Supreme Court has put its stamp on the constitutional validity of the GST (goods and services) law permitting collection of a cess to...

High Court stays action against some exporters for wrongly availing GST benefits

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 5, 2018

In what may provide a respite for many exporters, the Gujarat High Court has asked the primary anti-smuggling intelligence agency to not ...

Govt may extend term of GST anti-profiteering watchdog

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 5, 2018

The government may extend the term of the National Anti-profiteering Authority (NAA) beyond its original two-year mandate, with policymak...

GST cheer for government as states’ shortfall drops

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 5, 2018

Amid a sense of doom and gloom spread by the falling rupee, rising oil prices and widening current account deficit, the government has at...

Aggrieved exporters likely to get relief from GST Council on Friday

GST & Other Indirect Taxes | By ALOK PATNIA | Sep 28, 2018

The goods & services tax (GST) Council at its meeting on Friday is likely to give relief to the exporters who were denied refunds due...

Lifestyle penalized for not passing on lower GST benefits

GST & Other Indirect Taxes | By ALOK PATNIA | Sep 28, 2018

Piling pressure on Indian companies to pass on the benefits of rate cuts under the goods and services tax (GST) to consumers, the nationa...

Toll Free:

Toll Free:  Contact Us

Contact Us