GST & Other Indirect Taxes

10 grey areas in Service Tax

GST & Other Indirect Taxes | By Editor | Jun 1, 2016

There are many ambiguities related to service tax provisions that are not clear to business owners. Many new provisions have been intro...

IS ANNUAL RETURN OF SERVICE TAX A NEW BURDEN ON THE ASSESSEES?

GST & Other Indirect Taxes | By Editor | May 25, 2016

Is annual return of Service Tax a new burden on the assessees? Service tax assessee’s- here is the new burden!!! In addition to fil...

Outsource tax and regulatory compliances of your business to Taxmantra

Direct Taxes (including International Taxation) | By Editor | May 25, 2016

Outsource tax and regulatory compliances of your business to Taxmantra Our CEO, Alok Patnia tal...

Clarity between Service Tax and VAT

GST & Other Indirect Taxes | By Editor | May 4, 2016

Tax on service provided and received has been covered under Service Tax by the Government which is increasing on a fast track. From 12.36...

Penalties and Interest under the Service Tax Provisions

GST & Other Indirect Taxes | By Editor | Apr 20, 2016

Service tax refers to tax collected by the government of India from certain service providers for providing certain services. The person ...

Service Tax EXEMPT on Export of Service

GST & Other Indirect Taxes | By Editor | Apr 13, 2016

The term ‘Export of Service’ is neither defined in the Finance act nor in the Export of services rules. In International Trade the term ‘...

Notional interest accrued on deposit is free from service tax

Direct Taxes (including International Taxation) | By Editor | Apr 13, 2016

Service tax not payable on the notional interest accrued on the security deposit received on providing immovable property on rent. Case: ...

Rs 100 per day for non or late filing of service tax returns

Direct Taxes (including International Taxation) | By Editor | Apr 13, 2016

Service tax is an indirect tax levied on the services provided by a service provider in India. Service tax is paid by the end consumer of...

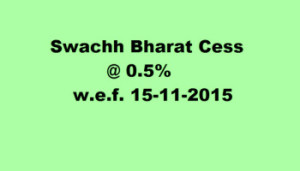

0.5% to be charged on taxable services from 15.11.2015 as Swachh Bharat Cess

GST & Other Indirect Taxes | By ALOK PATNIA | Nov 16, 2015

0.5% to be charged on taxable services from 15.11.2015 as Swachh Bharat Cess Swachh Bharat Cess has come into effect from 15th November 2...

We caught you!!! You are in dilemma to charge ST @ 12.36 or 14% on which invoices

GST & Other Indirect Taxes | By ALOK PATNIA | May 21, 2015

Government by issuing the notification has cleared about the effective date for applicability of new service tax rate. This notification ...

From 1st June, expenses will increase as service tax shall be charged at 14%

GST & Other Indirect Taxes | By ALOK PATNIA | May 20, 2015

The new rate of service tax i.e., 14% shall come into effect from 1st June, 2015. From the date of Budget announcement, among many change...

You need to pay service tax by 31st march – Is it Fair?

GST & Other Indirect Taxes | By ALOK PATNIA | Mar 19, 2015

31st March is already marked with many due dates for compliances to be made. Are you aware of the due date of service tax payment? If not...

Toll Free:

Toll Free:  Contact Us

Contact Us