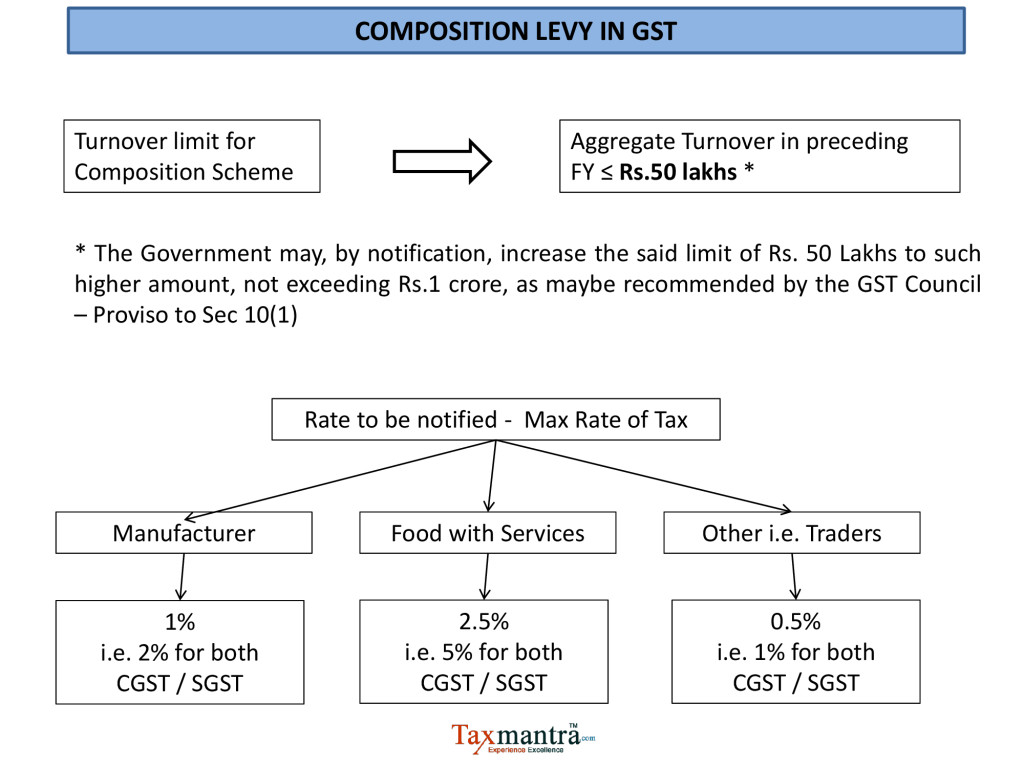

Section 10 (1) – Composition Levy

Notwithstanding anything to the contrary contained in this Act but subject to the provisions of sub-sections (3) and (4) of section 9, a registered person, whose aggregate turnover in the preceding financial year did not exceed fifty lakh rupees, may opt to pay, in lieu of the tax payable by him, an amount calculated at such rate as may be prescribed, but not exceeding,––

(a) one per cent of the turnover in State or turnover in Union territory in case of a manufacturer,

(b) two and a half per cent of the turnover in State or turnover in Union territory in case of persons engaged in making supplies referred to in clause (b) of paragraph 6 of Schedule II, and

(c) half per cent of the turnover in State or turnover in Union territory in case of other suppliers,

subject to such conditions and restrictions as may be prescribed:

Provided that the Government may, by notification, increase the said limit of fifty lakh rupees to such higher amount, not exceeding one crore rupees, as may be recommended by the Council.

Update: The limit of fifty lakh has been revised to Rs. 75 lakhs.Traders who have below Rs 75 lakh turnover will have to pay 1 per cent tax, manufacturers will have to pay 2 per cent while restaurant businesses will have to pay 5 per cent if they opt to go for the Composition Scheme under GST.

ELIGIBLE PERSONS FOR COMPOSITION LEVY

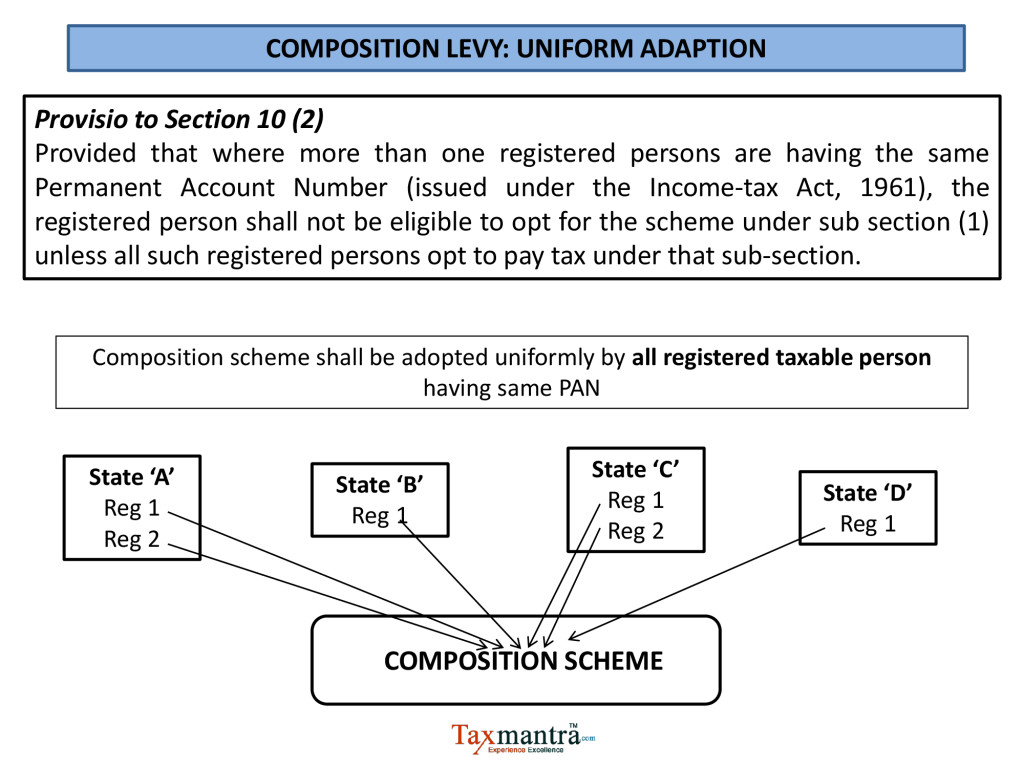

Section 10 (2)

The registered person shall be eligible to opt under sub-section (1), if:—

(a)he is not engaged in the supply of services other than supplies referred to in clause of paragraph 6 of Schedule II (i.e. Food with services);

(b)he is not engaged in making any supply of goods which are not leviable to tax under this Act;

(c)he is not engaged in making any inter-State outward supplies of goods;

(d)he is not engaged in making any supply of goods through an electronic commerce operator who is required to collect tax at source under section 52; and

(e)he is not a manufacturer of such goods as may be notified by the Government on the recommendations of the Council.

COMPOSTION LEVY : OTHER PROVISIONS

Section 10 (3) –

The option availed of by a registered person under sub-section (1) shall lapse with effect from the day on which his aggregate turnover during a financial year exceeds the limit specified under sub-section (1).

The day on which Aggregate turnover during a financial year exceeds Rs. 50 lakhs → Composition Scheme stands withdrawn.

Section 10 (4) –

A taxable person to whom the provisions of sub-section (1) apply shall not collect any tax from the recipient on supplies made by him nor shall he be entitled to any credit of input tax.

Composition Dealer cannot enter into credit chain →

1.Composition Dealer cannot collect tax from the recipient on supplies made by him

2.Composition Dealer shall not be entitled to any credit of input tax.

Sec 18 (1)(c) →Eligibility to avail ITC on stock on ceasing to pay tax under Composition Levy.

Section 10 (5) –

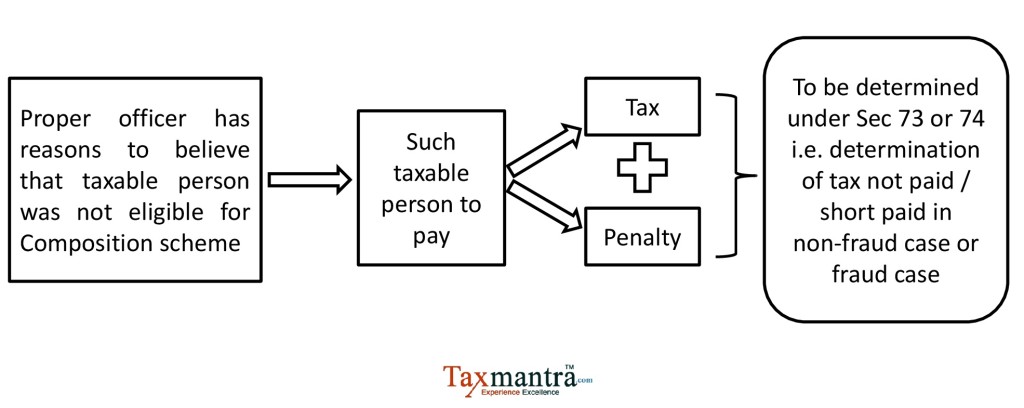

If the proper officer has reasons to believe that a taxable person has paid tax under sub-section (1) despite not being eligible, such person shall, in addition to any tax that may be payable by him under any other provisions of this Act, be liable to a penalty and the provisions of section 73 or section 74 shall, mutatis mutandis, apply for determination of tax and penalty.

COMPOSITION LEVY : OTHER IMPORTANT POINTS

Which returns are required to be filed by a taxable person registered under Composite Scheme?

The taxable person is required to furnish only one return i.e. GSTR-4 on a quarterly basis and an annual return in FORM GSTR-9A.

Is liability to pay taxes under Reverse Charge Mechanism covered under the Composite Scheme?

Any tax payable under Reverse Charge Mechanism will not be covered under the scheme. These taxes will be liable to be paid as a normal tax payer.

What are the transition provisions if a business transits from Composition Scheme under current regime to Regular Taxation under GST?

Taxpayers registered under composition scheme under the current regime will be allowed to take credit of input held in stock, or in semi-finished goods or in finished goods on the day immediately preceding the date from which they opt to be taxed as a regular tax payer.

What are the conditions for availing input credit on stock lying at the time of transition?

Following are the conditions which must be addressed by the taxpayer to avail credit on input at the time of transition from composition scheme to the normal scheme:

1.Such inputs or goods are intended to be used for making taxable supplies under GST law.

2.Taxpayer was eligible for CENVAT Credit on such goods under the previous regime, however, couldn’t claim it being under composition scheme.

3.Such goods are eligible for input tax credit under GST regime.

4.The taxpayer has legal evidence of input tax paid on such goods.

5.Such invoices were issued within a period of 12 months from GST applicable date.

Also, have a look at our article – Composition Scheme under GST-What is new

What is the treatment for input credit availed when transitioning from normal scheme to Composition Scheme?

When switching from normal scheme to composition scheme, the taxpayer shall be liable to pay an amount equal to the credit of input tax in respect of inputs held in stock on the day immediately preceding the date of such switchover. The balance of input tax credit after payment of such amount, if any lying in the credit ledger shall lapse.

Now businesses opting for composition scheme will have to declare so.

Eateries and shops that opt for the low-tax composition scheme will have to prominently display a board stating this and can’t charge goods and services tax (GST) from customers. Small establishments in the Rs 20 lakh to Rs 75 lakh annual turnover range are eligible for composition scheme.

Composition scheme norms specify that the entity has to mention the words ‘composition taxable person, not eligible to collect tax on supplies’ at the top of the bill of supply. ‘Composition taxable person’ has to be displayed prominently at all places of business.

Read more in our article: Declaration required for businesses opting for low-tax composition scheme

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

Toll Free:

Toll Free:  Contact Us

Contact Us