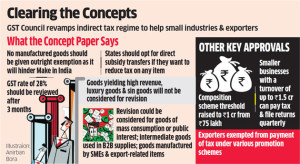

The GST Council shall not encourage any more tweaks in the rates of GST following a major revamp of the indirect tax regime on Friday to help small industries and exporters. The Council has adopted “Concept Paper” stating no manufactured goods should be given outright exemption as this would hinder the Make in India initiative. States should opt for direct subsidy transfers if they want to reduce tax incidence on any item. This suggests that companies looking for such breaks like Apple would not be able to get any outright tax exemptions.

“The whole idea is to look at the issue of rate revision afresh… There should be no ad hocism in rate revision,” said a government official.

The key principle behind the concept paper is that manufactured goods should not be placed in the nil bracket as it would then face nil customs duty, impacting the domestic manufacturing adversely.

“As a rule no manufactured good shall be exempt from GST,” according to the paper, which was approved by the council on Friday. On Friday, the council raised the composition scheme threshold to Rs 1 crore from Rs 75 lakh, allowed smaller businesses with a turnover of up to Rs 1.5 crore to pay tax and file returns quarterly instead of monthly and exempted exporters from payment of tax under various promotion schemes among other decisions.

Any revision shall be made in keeping in view that there shouldn’t be any blockage of input tax credit or the creation of an inverted duty structure in which input is higher than the finished product, the officials said. Also, any changes in tax rates shall be considered after a period of at least three months, allowing them to settle in first.

The concept paper contained for the revision of GST rate of 28% after 3 months based on the criteria that have been decided. However, goods yielding high revenue luxury goods and sin goods shall not be considered for revision. Revision can be made over the goods of mass consumption or public interest; intermediate goods that are used in business-to-business supplies; goods manufactured by small and medium enterprises; and export-related items. It shall keep the tax structure stable – said by tax experts.

“Frequent and ad hoc changes in GST rates are definitely not desirable… This mechanism would ensure that some general guidelines are followed for deciding the rates in future, while making an exception if needed,” said Pratik Jain, leader, indirect taxes, PwC. Jain hopes that many items in the 28% slab will move to the lower bracket of 18%.

“Benefits of GST can only be realized if rates are moderate,” Jain said. The council had decided on fitment of goods based on.

Sources –The Economic Times

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance

______________________________________________________________________________________________________________________________

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us