“If you don’t drive your business, you will be driven out of business (B.C. Forbes)”.

Unfortunately, it’s hard to drive when you cannot see. Despite massive investments in ERP, CRM, and other enterprise systems, many companies still do not have the information they need to make good business decisions. The problem is not a lack of information — it is a lack of insight.

As companies focus on growth, Chief Financial Officers are now assuming a more strategic role and are expected to deliver real insight to the C-suite.

So often—too often—I see the position of CFO as misunderstood or undervalued in growing companies. In such companies, there needs to be a paradigm shift as the company grows. Early-stage companies need to understand how a CFO can positively impact the company’s growth from every angle. CFOs drive operational gains and steer their companies’ growth strategies.

The CFO paints the picture for the business and translate the financial data into meaningful commentary, trends, and actions, and rightly so, given the ever-changing business environment we operate in.

Small management teams allow companies to make quick decisions, enabling them to react faster and more nimbly to market changes than the Goliaths they’re competing with can. However, having only a few leaders — including those who may have little to no previous experience running a business — can also mean limited access to the skills and expertise a fast-growing company needs to succeed. One area where a guiding hand is needed in a growing company, but often lacking, is in the finance function. More specifically, many startups do not have CFO leadership.

CFOs can help lead the charge when it comes to growing your company. Because your business strategies are deeply woven in with your financial strategies, you need CFO support for any and all of your growth initiatives: from the planning stages through to execution.

Growing businesses often put off hiring a CFO until they are more established or preparing for an initial public offering (IPO). However, waiting too long to staff this critical role could be a mistake.

That risk becomes more obvious when you consider just some of the ways that CFOs can help startups and fast-growing companies, including pre-IPO companies, to structure and run their operations.

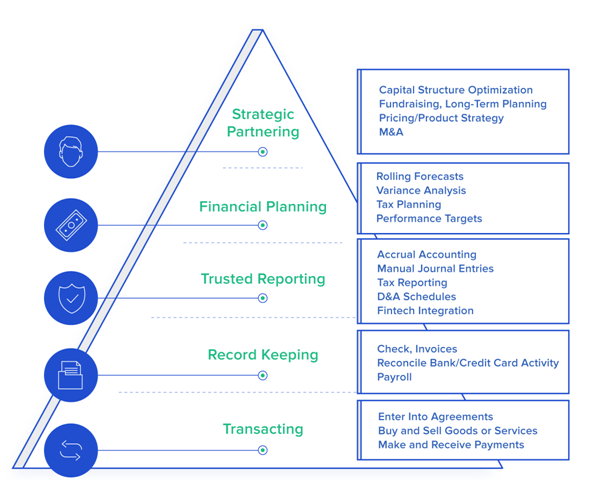

The real question might not be how long can you survive, but how soon will you start benefitting from the contributions of an experienced financial leader. In my 15+ years of experience as a finance director and financial consultant, I have found that the best way to judge whether or not a company needs to hire a CFO is by assessing where they stand on “the hierarchy of needs,” which I explain below. The following analysis will help businesses identify where they are in the hierarchy and be a guide to hiring options that best address their current needs and how to move to the next level.

Much like Maslow’s Hierarchy of Needs, a business has a hierarchy of financial management needs. These are displayed in the chart beloW:

The more basic the needs, the more basic the skills needed to perform them. As the needs progress so do the skills, as well as the insight required to satisfy those needs. The basic needs are clerical and can be met with technical training, but the more advanced needs add a strategic component that is best met by someone with extensive business experience. Different businesses’ needs grow at different rates based on industry, market opportunity, ambitions, and resources. One need cannot be met if a preceding need is left unmet.

The CFO keeps the ship floating through rough waters—safeguarding employees’ health, securing liquidity, monitoring cash flow and payment terms, ensuring the functioning of the supply chain, assessing effects on P&L and the balance sheet, reviewing customers’ and suppliers’ situations, and initiating cost-reduction programs. That is all very challenging indeed. But then the CFO serves as the ship’s scout—watching for key trends that are emerging or that have accelerated as a result of as digitization and changes in consumer behavior.

__________________________________________________________________________________________________________

We’re listening:

For any query, support or feedback, reach us at Taxmantra Global CFO Advisory Services or WA us at +91-9230033070 or Call us at 1800-102-7550

In these troubled times -COVID-19, we, at Taxmantra Global urge you to stay safe – social distancing, personal hygiene, and health care are of utmost importance! Stay safe!

______________________________________________________________________________________________________

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us