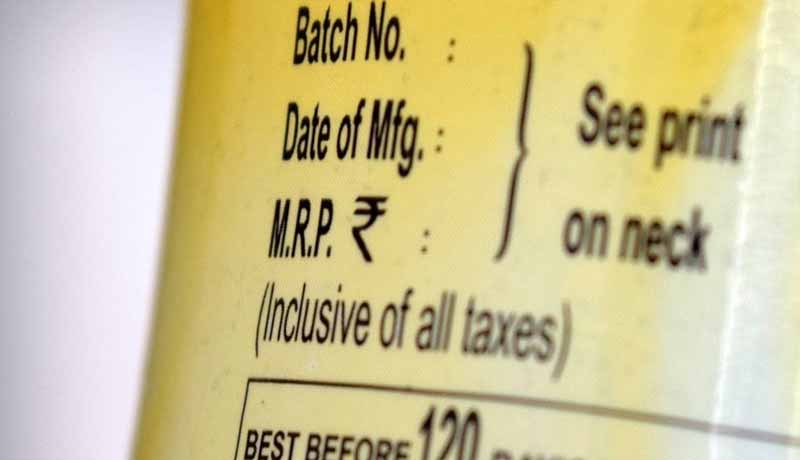

The government has allowed companies, till March 2018, to paste price stickers on unsold packaged products to reflect new MRP post GST, Consumer Affairs Minister Ram Vilas Paswan said today. After Goods and Services Tax (GST) became effective from July 1, companies were asked to use stickers on unsold packaged commodities to display new maximum retail price (MRP) till September, which was later extended till December.

The government has allowed companies, till March 2018, to paste price stickers on unsold packaged products to reflect new MRP post GST, Consumer Affairs Minister Ram Vilas Paswan said today. After Goods and Services Tax (GST) became effective from July 1, companies were asked to use stickers on unsold packaged commodities to display new maximum retail price (MRP) till September, which was later extended till December.

When rates of about 200 items were cut in mid-November, the ministry permitted to paste additional stickers under the the Legal Metrology (Packaged Commodities) Rules, 2011. “In case of GST, we allowed companies to paste stickers on unsold packaged products till December. In last GST council

meeting, GST rates have been reduced for about 200 items. So, we have decided to extend the December deadline to March 2018,” Paswan told reporters here.

Last month, the ministry had allowed to “affix an additional sticker or stamping or online printing for declaring the reduced MRP on the pre-packaged commodity”. As many as 178 items of daily use have been shifted from the top tax bracket of 28 per cent to 18 per cent, while a uniform 5 per cent tax was prescribed for all restaurants, both air- conditioned and non-AC. To ensure GST cuts are passed on to consumers, Paswan had recently directed state legal metrology officers to check if companies are pasting the new MRP stickers.

Last month, the GST Council in its 23rd meeting had approved the biggest ever change to the tax rates since the new indirect tax regime came into effect from July 1. Under the changes, 178 everyday items would be taxed at the lower rate of 18 per cent, from the 28 per cent. After the latest change, just 50 items will remain in the highest tax bracket of 28 per cent, mainly white goods such as washing machines and refrigerators, and “sin” items such as tobacco.

Source: NDTV

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us