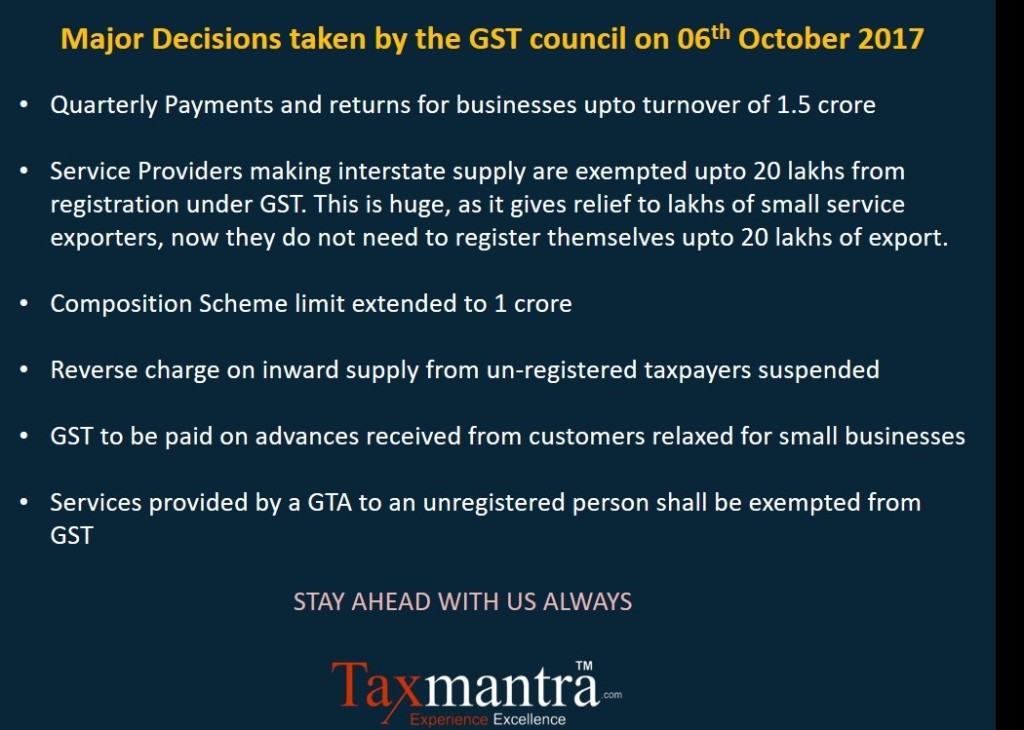

The GST Council in its much-awaited meeting on 06th October 2017, has recommended a host of measures to ease the burden of compliance on small and medium-sized businesses. GST Compliance Made Easy for Small Size Businesses with quarterly returns and other reliefs. Let’s understand all the recommendations as suggested by the GST council to the Government.

- Composition Scheme

The composition scheme shall be made available to taxpayers having an annual aggregate turnover of up to Rs. 1 crore as compared to the current turnover threshold of Rs. 75 lacs. This threshold of turnover for special category States, except Jammu & Kashmir and Uttarakhand, shall be increased to Rs. 75 lacs from Rs. 50 lacs.The turnover threshold for Jammu & Kashmir and Uttarakhand shall be Rs. 1 crore. The facility of availing composition under the increased threshold shall be available to both migrated and new taxpayers up to 31.03.2018. The option once exercised shall become operational from the first day of the month immediately succeeding the month in which the option to avail the composition scheme is exercised. New entrants to this scheme shall have to file the return in FORM GSTR-4 only for that portion of the quarter from when the scheme becomes operational and shall file returns as a normal taxpayer for the preceding tax period. The increase in the turnover threshold will make it possible for

The facility of availing composition under the increased threshold shall be available to both migrated and new taxpayers up to 31.03.2018. The option once exercised shall become operational from the first day of the month immediately succeeding the month in which the option to avail the composition scheme is exercised. New entrants to this scheme shall have to file the return in FORM GSTR-4 only for that portion of the quarter from when the scheme becomes operational and shall file returns as a normal taxpayer for the preceding tax period. The increase in the turnover threshold will make it possible for

New entrants to this scheme shall have to file the return in FORM GSTR-4 only for that portion of the quarter from when the scheme becomes operational and shall file returns as a normal taxpayer for the preceding tax period. The increase in the turnover threshold will make it possible for

The facility of availing composition under the increased threshold shall be available to both migrated and new taxpayers up to 31.03.2018. The option once exercised shall become operational from the first day of the month immediately succeeding the month in which the option to avail the composition scheme is exercised.

New entrants to this scheme shall have to file the return in FORM GSTR-4 only for that portion of the quarter from when the scheme becomes operational and shall file returns as a normal taxpayer for the preceding tax period. The increase in the turnover threshold will make it possible for a greater number of taxpayers to avail the benefit of easier compliance under the composition scheme and is expected to greatly benefit the MSME sector.

Persons who are otherwise eligible for composition scheme but are providing any exempt service (such as extending deposits to banks for which interest is being received) were being considered ineligible for the said scheme. It has been decided that such persons who are otherwise eligible for availing the composition scheme and are providing any exempt service, shall be eligible for the composition scheme.

Our View – This is a good measure, in addition, the restriction of no interstate sale by a composition dealer should also be removed off.

2. Service Providers making interstate supply are exempted upto 20 lakhs from registration under GST

Presently, anyone making inter-state taxable supplies, except inter-State job worker, is compulsorily required to register, irrespective of turnover.

It has now been decided to exempt those service providers whose annual aggregate turnover is less than Rs. 20 lacs (Rs. 10 lacs in special category states except J & K) from obtaining registration even if they are making inter-State taxable supplies of services. This measure is expected to significantly reduce the compliance cost of small service providers.

Our View – This is huge, this not only gives relief to the service providers within India but also to lakhs of small service exporters, now they do not need to register themselves upto 20 lakhs of export since export was characterized as an inter-state sale, wherein the registration was mandatory. This has been waived off.

3. Ease in Return filing and payments for small size businesses

To facilitate the ease of payment and return filing for small and medium businesses with annual aggregate turnover up to Rs. 1.5 crores, it has been decided that such taxpayers shall be required to file quarterly returns in FORM GSTR-1,2 & 3 and pay taxes only on a quarterly basis, starting from the Third Quarter of this Financial Year i.e. October-December, 2017. The registered buyers from such small taxpayers would be eligible to avail ITC on a monthly basis. The due dates for filing the quarterly returns for such taxpayers shall be announced in due course. Meanwhile, all taxpayers will be required to file FORM GSTR-3B on a monthly basis

The registered buyers from such small taxpayers would be eligible to avail ITC on a monthly basis. The due dates for filing the quarterly returns for such taxpayers shall be announced in due course. Meanwhile, all taxpayers will be required to file FORM GSTR-3B on a monthly basis until December 2017. All taxpayers are also required to file FORM GSTR-1, 2 & 3 for the months of July, August and

All taxpayers are also required to file FORM GSTR-1, 2 & 3 for the months of July, August and September 2017. Due dates for filing the returns for the month of July, 2017 have already been announced. The due dates for the months of August and September, 2017 will be announced in due course.

Our view – This is an excelllent measure, however, we are of the view that this quarterly filing of returns should be the norm for all the taxpayers, and monthly or quarterly tax payments should have been based on the size of the business.

Also, there is lack of clarity with respect to the filing of GSTR 3B for the quarter months ( OCT-DEC 17) for small size businesses, as now they have to do quarterly filing from OCT 17 quarter.

4. Reverse charge on inward supply from un-registered taxpayers suspended

The reverse charge mechanism under sub-section (4) of section 9 of the CGST Act, 2017 and under sub-section (4) of section 5 of the IGST Act, 2017 shall be suspended till 31.03.2018 and will be reviewed by a committee of experts. This will benefit small businesses and substantially reduce compliance costs.

Our view – In the first instance, there was no need for this provision, and this should be completely abolished.

5. GST to be paid on advances received from customers relaxed for small businesses

The requirement to pay GST on advances received is also proving to be burdensome for small dealers and manufacturers. In order to mitigate their inconvenience on this account, it has been decided that taxpayers having annual aggregate turnover up to Rs. 1.5 crores shall not be required to pay GST at the time of receipt of advances on account of supply of goods. The GST on such supplies shall be payable only when the supply of goods is made.

Our view – This is a welcome move, and we hope that this becomes the norm for all the taxpayers, there is no need to pay GST till the sale actually happens, otherwise, it creates unnecessary complications.

6. services provided by a GTA to an unregistered person shall be exempted from GST

It has come to light that Goods Transport Agencies (GTAs) are not willing to provide services to unregistered persons. In order to remove the hardship being faced by small unregistered businesses on this account, the services provided by a GTA to an unregistered person shall be exempted from GST.

It has come to light that Goods Transport Agencies (GTAs) are not willing to provide services to unregistered persons. In order to remove the hardship being faced by small unregistered businesses on this account, the services provided by a GTA to an unregistered person shall be exempted from GST.

Our view – This is a welcome move and will help to reduce genuine hardship.

Other Facilitation Measures

- After assessing the readiness of the trade, industry and Government departments, it has been decided that registration and operationalization of TDS/TCS provisions shall be postponed till 31.03.2018.

- The e-way bill system shall be introduced in a staggered manner with effect from 01.01.2018 and shall be rolled out nationwide with effect from 01.04.2018. This isin order to give trade and industry more time to acclimatize itself with the GST regime.

- The last date for filing the return in FORM GSTR-4 by a taxpayer under composition scheme for the quarter July-September, 2017 shall be extended to 15.11.2017. Also, the last date for filing the return in FORM GSTR-6 by an input service distributor for the months of July, August and September, 2017 shall be extended to 15.11.2017.

- Invoice Rules are being modified to provide relief to certain classes of registered persons.

Keep following this space for more updates. We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us