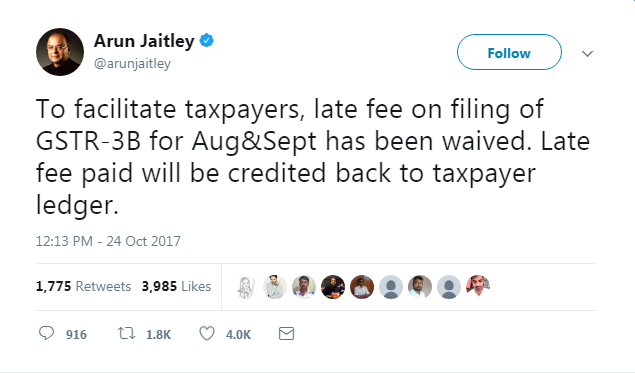

The government on Tuesday tweaked the working of GST (Goods and Services Tax) yet again to provide relief for the taxpayers. Finance Minister Arun Jaitley tweeted via his verified handle that the late fee on filing of GSTR-3B for the month of August and September has been waived. The tweet further said that the late fee amount will be credited back to the ledger of taxpayers who have already paid it.

The government on Tuesday tweaked the working of GST (Goods and Services Tax) yet again to provide relief for the taxpayers. Finance Minister Arun Jaitley tweeted via his verified handle that the late fee on filing of GSTR-3B for the month of August and September has been waived. The tweet further said that the late fee amount will be credited back to the ledger of taxpayers who have already paid it.

The waiver comes ahead of some major announcements expected to be made by Jaitley later in the day.

The government had earlier waived late fee for delayed filing of the maiden returns for the month of July under the Goods and Services Tax (GST) regime. Businesses have been demanding that the government waives penalty for delayed filing of 3B returns. The GST law provides for a fee of Rs 100 per day on Central GST and an equivalent amount on State GST in case of late filing of returns and payment of taxes.

On Monday, the government had eased the billing and compliance burden by doing away with invoices detailing prices and taxes for each item under GST. Retailers now, will also not have to issue separate invoices for exempted items taxed at the 0% rate and can club all purchases in one bill.

Source: Times of India

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us