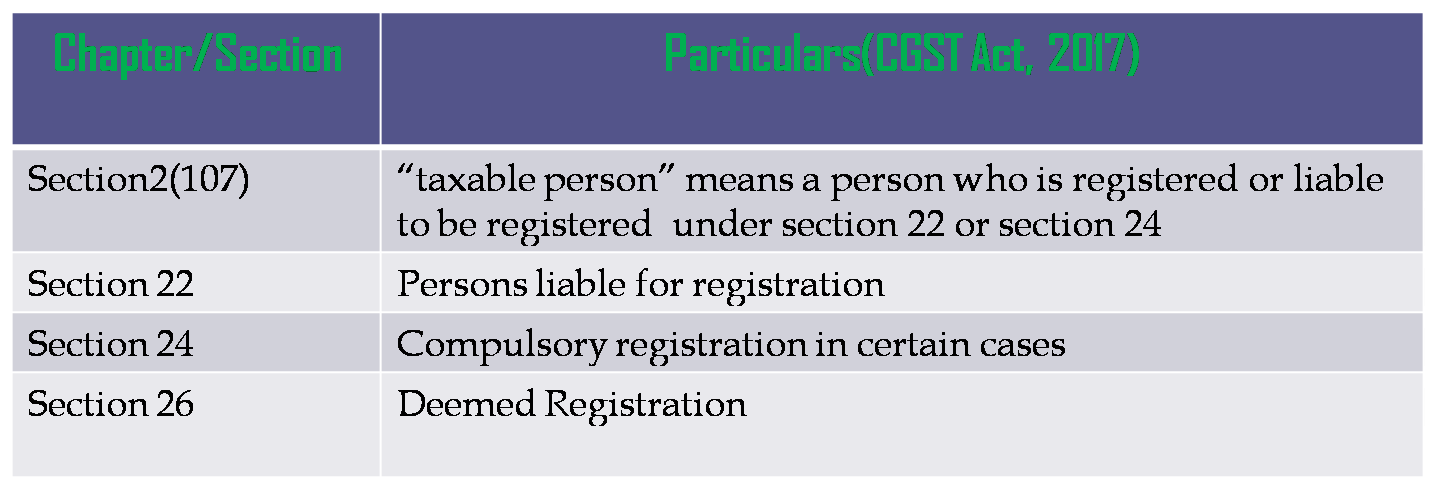

Taxable person provisions at a glance

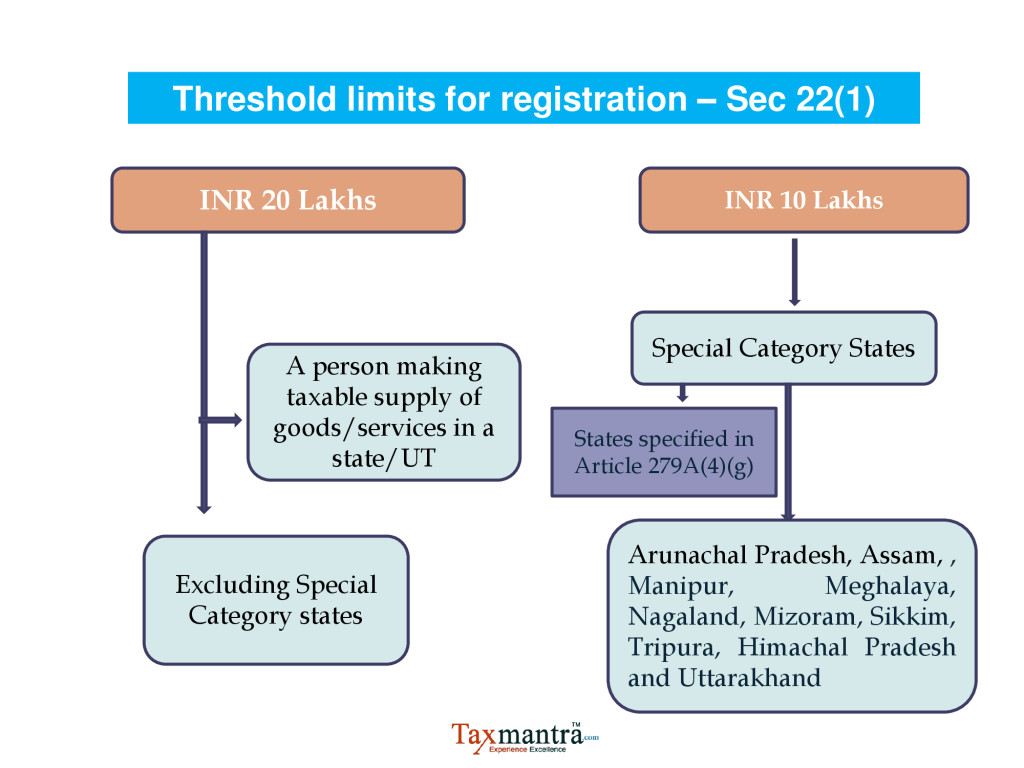

Threshold Limit for GST Registration

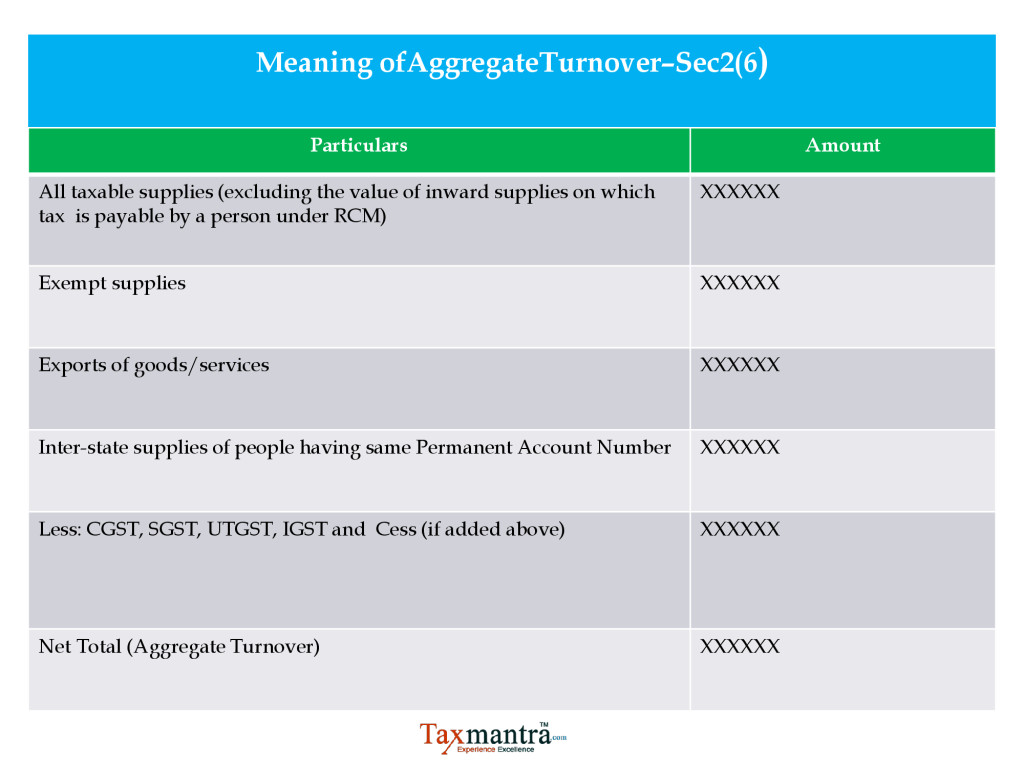

Threshold limits to be calculated on the basis of “Aggregate Turnover”

“Aggregate Turnover” means the aggregate value of all taxable supplies(excluding the value of inward supplies, on which tax is payable on reverse charge basis), exempt supplies, export of goods and services or both or inter-state supplies of people having same Permanent Account Number, to be computed in all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess.

Meaning of Aggregate Turnover–Sec2(6)

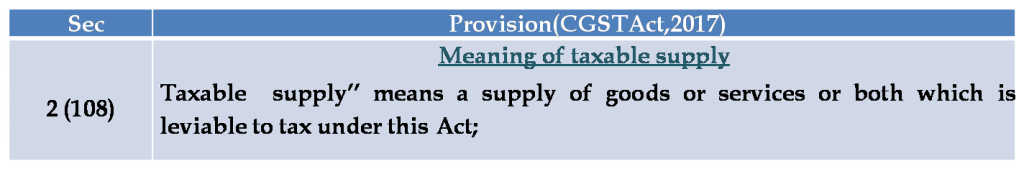

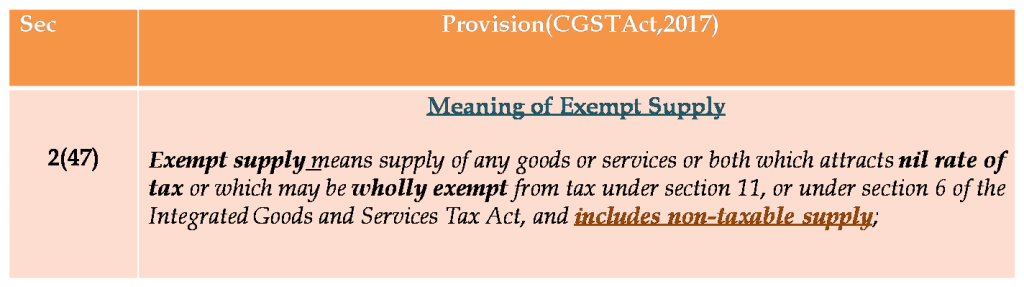

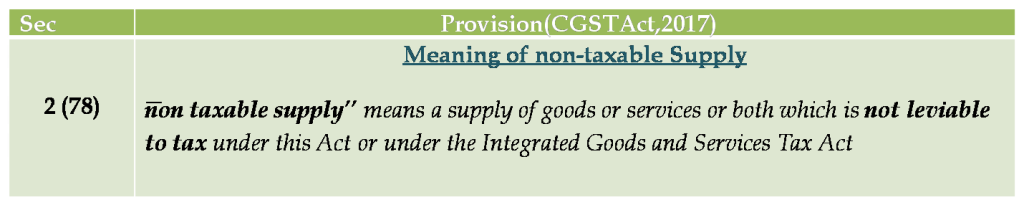

Meaning of key terms

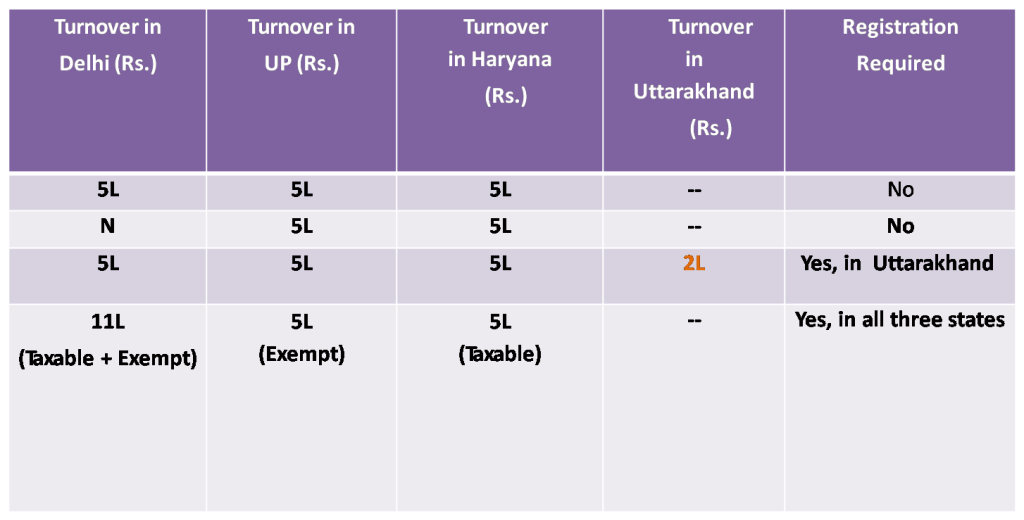

Examples to compute Aggregate Turnover

Inclusions in Aggregate Turnover

Sec 22(1) Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees:

Explanation (i) to Sec22 the expression ͞aggregate turnover ͟shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals:

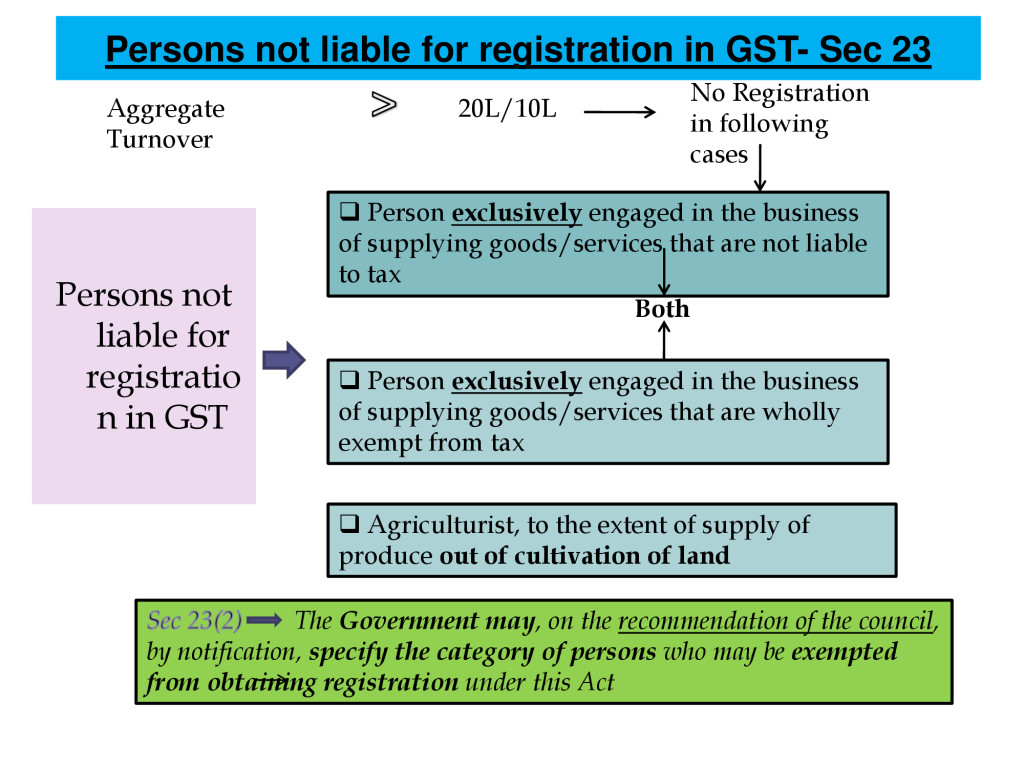

Persons not liable for registration

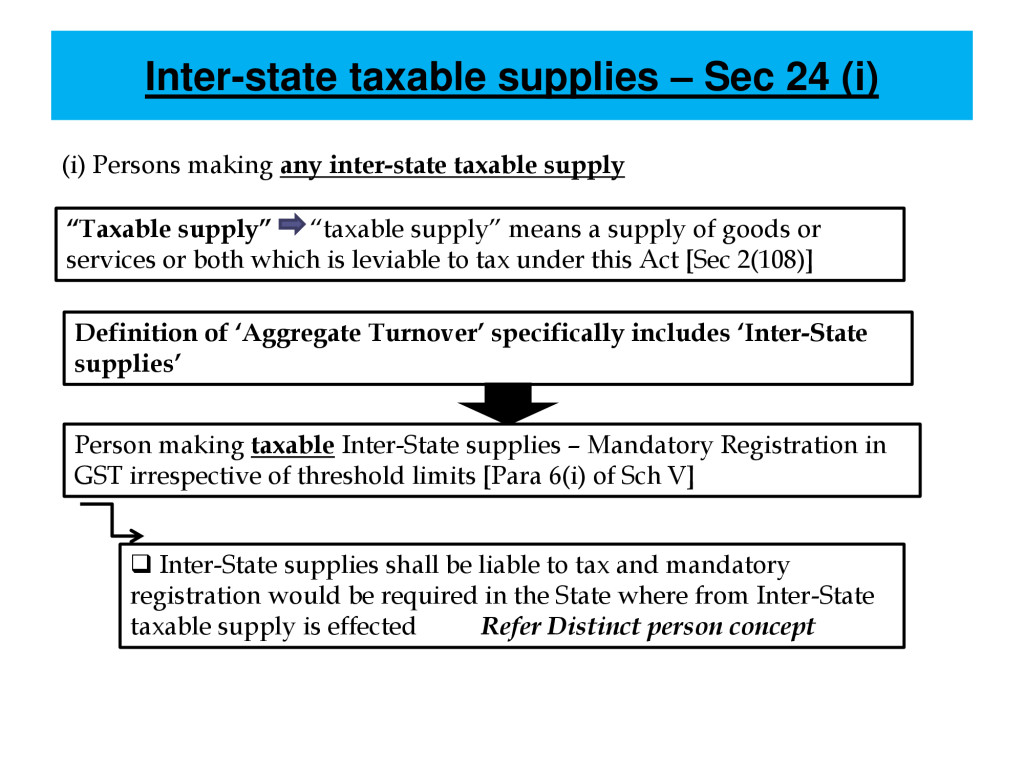

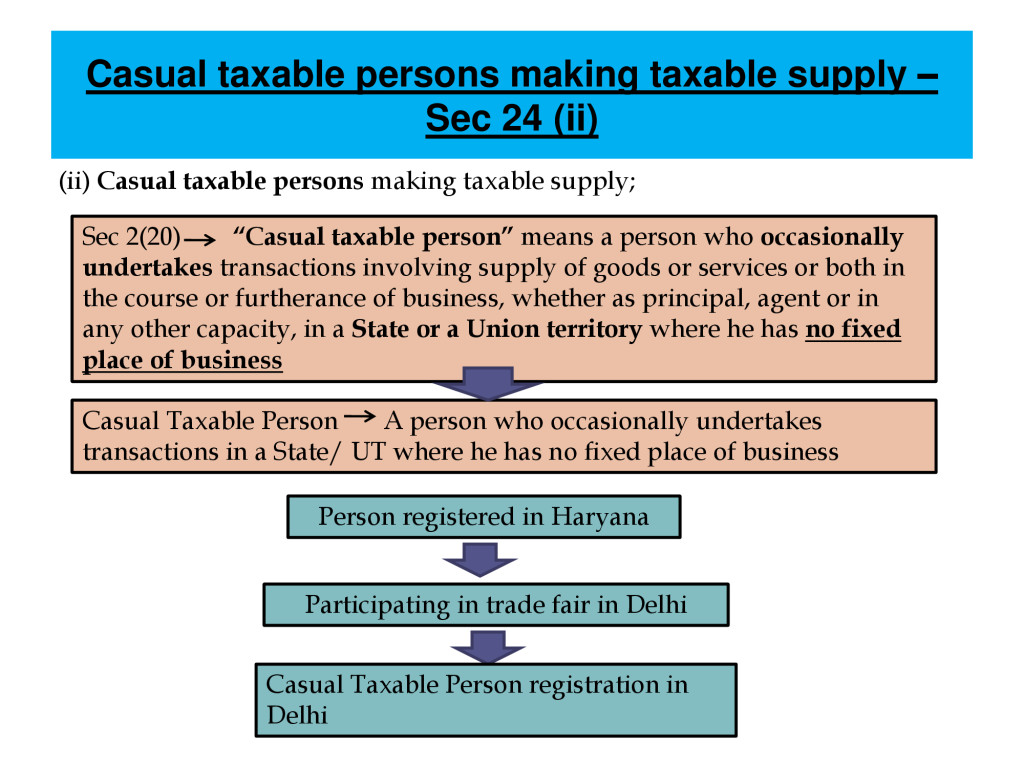

Mandatory registration irrespective of threshold

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us