Blogs

TDS not to be deducted on GST element

GST & Other Indirect Taxes | By Editor | Last updated on Oct 5, 2017

F. No. 275/59/2012-IT (B) Government of India Ministry of FinanceDepartment of RevenueCentral Board of Direct TaxesNorth Block, New Delh...

Payment of GST on Export of Services – Letter of undertaking or Bond

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Payment of GST on Export of Services from India – Export of services under GST regime with filing of LTU/Bond for export under GST Format...

जीएसटी के अंतर्गत माल और सेवाओं की आपूर्ति का स्थान

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

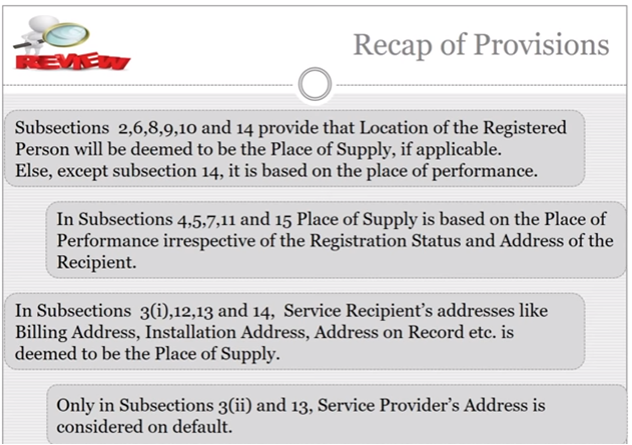

यह सामग्री मूलतः निम्नलिखित विषयों को कवर करती है: आपूर्ति के स्थान की प्रासंगिकता माल की आपूर्ति के स्थान का निर्धारण करने के लिए नियम स...

What are the documents required to register for GST?

GST & Other Indirect Taxes | By Editor | Last updated on Oct 5, 2017

Documents Required to Complete the Application for New Registration: Please keep the scanned copy of below mentioned documents handy to f...

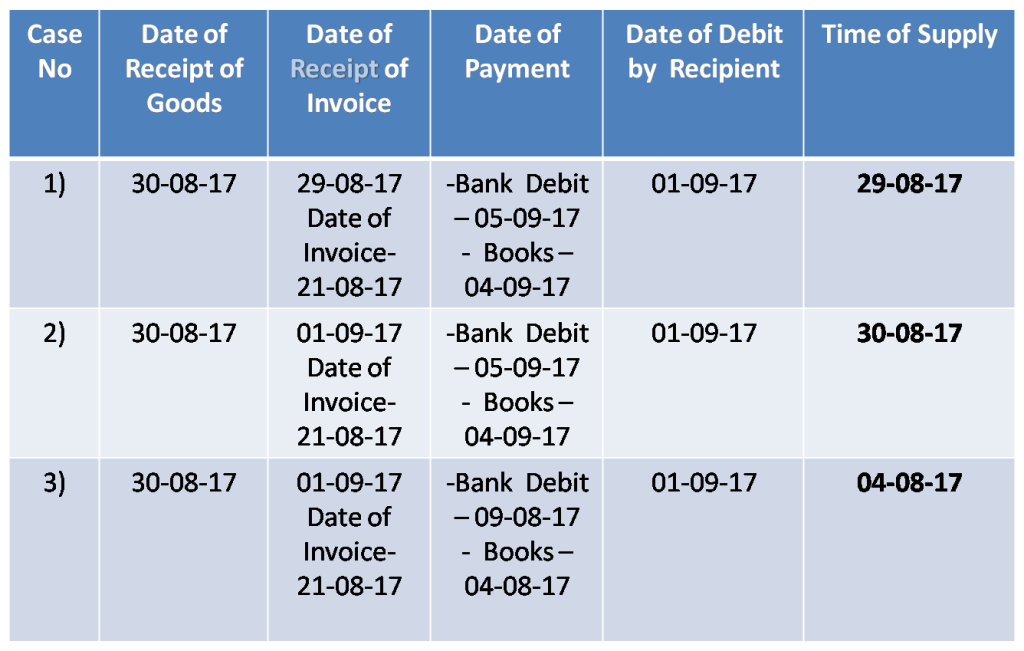

जीएसटी के तहत माल और सेवाओं की आपूर्ति का समय

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

माल की आपूर्ति का समय (1) वस्तुओं पर जीएसटी का भुगतान करने की जिम्मेदारी इस खंड के प्रावधानों के अनुसार निर्धारित आपूर्ति के समय उत...

Income Tax Return filing – FY 2017 -18 : Key Changes in ITR Forms you should know about

Direct Taxes (including International Taxation) | By ALOK PATNIA | Last updated on Oct 5, 2017

New Income Tax Forms has been notified by CBDT for the Assessment Year 2017-18. The biggest change is the number of ITR forms have reduce...

GSTIN display on sign boards must for businesses

GST & Other Indirect Taxes | By Editor | Last updated on Oct 5, 2017

Traders and businesses will have to display the GST registration number on their business sign boards and the registration certificate in...

Declaration required for businesses opting for low-tax composition scheme

GST & Other Indirect Taxes | By Editor | Last updated on Oct 5, 2017

Eateries and shops that opt for the low-tax composition scheme will have to prominently display a board stating this and can’t cha...

GST on sanitary napkins – Is Govt’s justification valid?

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Last updated on Oct 5, 2017

“There are some remarks made by various column writers on GST rate on sanitary napkins. It may be mentioned that the tax incidence on thi...

Toll Free:

Toll Free:  Contact Us

Contact Us