Blogs

Now Pay Service Tax on Websites and Servers Hosted Abroad

GST & Other Indirect Taxes | By Rahul Agarwalla | Last updated on Nov 22, 2019

Now Pay Service Tax on Websites and Servers hosted abroad as service tax has been levied on import of online information and database acc...

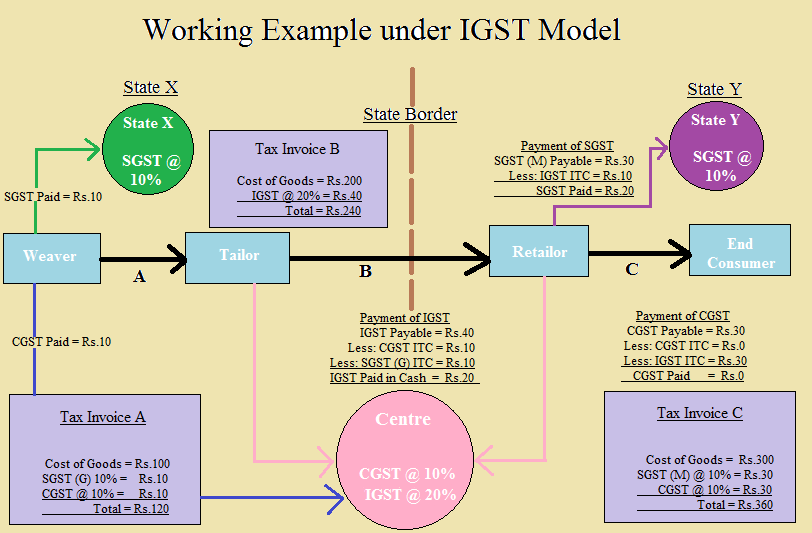

All You Need To Know About GST – FAQs

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Last updated on Oct 5, 2017

The Government is eager to roll-out the Goods and Services Tax (GST) – the biggest indirect tax reform in the history of our...

Deductions of Interest and Principal Component of Housing Loan

Direct Taxes (including International Taxation) | By Editor | Last updated on Oct 5, 2017

Home Loan is something for which nowadays Individuals specifically Salaried Individuals opt for. Availing a home loan is not a tough task...

6 steps of trademark registration in India

Corporate Law & Intellectual Property Rights | By Dipanjali Chakraborty | Last updated on Nov 22, 2019

Trademark is a symbol, word, phrase, logo, or combination of these that legally distinguishes one entity’s product from any others. Any i...

All about PMGKY scheme – A presentation

News & FAQs | By ALOK PATNIA | Last updated on Mar 29, 2017

Last chance to come clean for black money holders! Addressing the concerns of demonetization, an alternative scheme namely, the ‘Taxation...

5 signs your business is ready to outsource tax and accounting compliances

Corporate Law & Intellectual Property Rights | By Dipanjali Chakraborty | Last updated on Oct 5, 2017

Tax & regulatory services have been pain points for all businesses. In the hustle and bustle of growing your businesses,they often ta...

Modi Proposes PMGKY – Unaccounted Cash deposits to be taxed @50 %

News & FAQs | By ALOK PATNIA | Last updated on Nov 29, 2016

Modi comes up with another master stroke in the form of amendments of the existing Income Tax laws and introduction of the new Income Dis...

Companies to pass the benefit of tax reduction to customers and more updates – GST bill red...

News & FAQs | By Editor | Last updated on Nov 28, 2016

In a flurry of GST related announcements, there came some reliefs for the stock markets. The definition of “goods” under the Goods & ...

GST Update: Release of Draft Model GST Law, IGST Law & Compensation Law

News & FAQs | By Editor | Last updated on Nov 28, 2016

Press Information BureauGovernment of IndiaMinistry of Finance26-November-2016 14:33 IST Draft Model GST Law, Draft IGST Law and Draft Co...

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us