Blogs

How to register LLP in Singapore

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Last updated on May 19, 2020

There are several business structures available for entrepreneurs to set up in Singapore. Singapore also recognizes Limited Liability Par...

Defense FDI limit increased, Coal monopoly abolished – Key Highlights -Atmanirbhar Bharat Abhiyaa...

COVID-19 Resources | By Editor | Last updated on Jun 1, 2020

Union Finance Minister Nirmala Sitharaman’s fourth tranche of economic measures on Saturday evening focused on structural reforms. ...

Support for street vendors, focus on essential commodities – Key Highlights -Atmanirbhar Bh...

COVID-19 Resources | By Editor | Last updated on Jun 1, 2020

Finance Minister Nirmala Sitharaman addressed a press conference on Friday to announce the third tranche of government’s economic s...

Case Study- How to hold EGM during Lockdown

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Last updated on Jun 1, 2020

Case Study – Founders of Startup Pvt Ltd a Bangalore based Entity has finalized the Term Sheet with an investor who wishes to inves...

Support for Migrant workers and Farmers, CLSS gets extended: Atmanirbhar Bharat Abhiyaan Part 2

COVID-19 Resources | By Editor | Last updated on Jun 1, 2020

Finance Minister Nirmala Sitharaman on Thursday (May 14) announced the second set of measures that are part of a Rs 20 lakh crore economi...

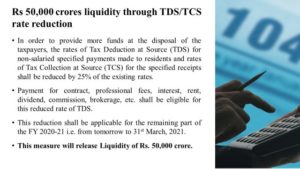

TDS, TCS reduced by 25% – Atmanirbhar Bharat Abhiyaan Part 1

COVID-19 Resources | By Editor | Last updated on Jun 1, 2020

The Central Board of Income Tax on Wednesday ordered a 25% reduction in the rate of income tax deducted at source (TDS) and tax collectio...

MCA changes AGM and EGM rules due to COVID 19

CFO Advisory Services | By Soumik Kumar Sen | Last updated on Jun 1, 2020

Due to COVID-19 pandemic, the Ministry of Corporate Affairs(MCA) have come up with various relaxations and guidelines for convening of AG...

Key highlights from Nirmala Sitharaman’s Press Conference – Atmanirbhar Bharat Abhiyaan

COVID-19 Resources | By Editor | Last updated on Jun 1, 2020

Yesterday (12th May,2020), PM Narendra Modi announced a special Economic Package of Rs. 20lakhs crores. Starting from today and spreading...

No GST on full time director’s salary

GST & Other Indirect Taxes | By Editor | Last updated on Jun 1, 2020

The controversy on whether remuneration paid to directors of a company is subject to Goods and Services Tax (GST) has been put to rest by...

Toll Free:

Toll Free:  Contact Us

Contact Us