Blogs

Direct Tax Laws Task Force To Submit Report By May 31

Direct Taxes (including International Taxation) | By ALOK PATNIA | Last updated on Mar 2, 2019

A task force set up under the Central Board of Direct Taxes (CBDT) to draft a new direct tax law and replace the existing Income Tax Act ...

NAREDCO seeks more liquidity for real estate sector; lower GST on cement

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Mar 2, 2019

Realtors’ body NAREDCO on Friday said the real estate sector is in financial stress due to lack of funding from banks and NBFCs and...

Singapore signs comprehensive partnership agreement with the United Arab Emirates

Corporate Law & Intellectual Property Rights | By ALOK PATNIA | Last updated on Mar 1, 2019

Singapore will enjoy stronger ties with the United Arab Emirates (UAE) under a new agreement. In a statement, the Ministry of Foreign Aff...

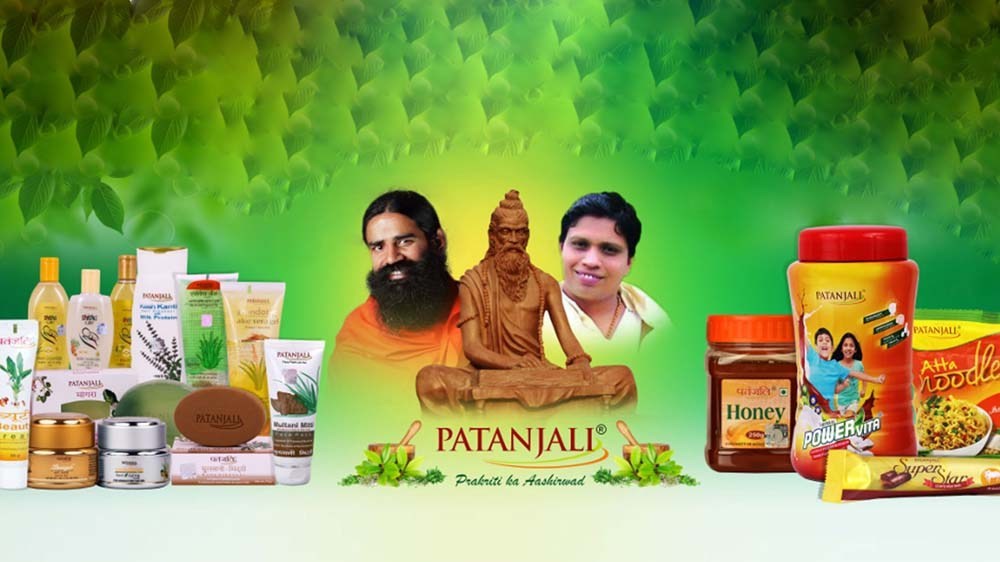

Patanjali distributors under anti-profiteering lens for not passing GST benefits

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Mar 1, 2019

Patanjali Ayurved distributors have come under the lens of National Anti-profiteering Authority (NAA) for not passing on lower GST rate b...

Realtors seek clarity on GST exemption on development rights

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Mar 1, 2019

Realty developers are seeking clarity on recent exemption offered from the goods & services tax (GST) levied on development rights, i...

10,000 penalty for non filing of E-Form Active

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Last updated on Feb 28, 2019

MCA has recently modified the Incorporation Rules. Now any company which was incorporated before 31st December, 2017 has to file E-Form A...

GST Council Likely To Meet Next Week To Discuss Cement Rate Cut

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Feb 14, 2019

The GST Council is likely to meet on February 20 to discuss a proposal to slash tax on cement to 18 per cent from 28 per cent and also co...

Qatar seeks inclusion of natural gas in GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Feb 11, 2019

India’s largest LNG supplier Qatar on February 10 urged the central government to include natural gas in GST to help create demand ...

Government favours cut in GST to 5% from effective rate of 12% for residential properties

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Feb 11, 2019

A Group of Ministers (GoM) formed to analyse tax rates and issues being faced by the real estate sector under the goods and services tax ...

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us