Blogs

Knitwear industry unhappy over GST on job works

News & FAQs | By ALOK PATNIA | Last updated on Nov 14, 2017

While welcoming the reduction of GST rates for most of the textile raw materials, knitwear unit owners here expressed unhappiness over jo...

Govt. specifies list of items on which GST rate have been reduced

News & FAQs | By ALOK PATNIA | Last updated on Nov 14, 2017

The GST Council has specified the list of 177 items on which GST rate would be reduced from 28% to 18%. Further, on two items GST rate wo...

Improve GST filing services: Gujarat traders

News & FAQs | By ALOK PATNIA | Last updated on Nov 14, 2017

Gujarat traders have welcomed the changes in GST structure, but have urged the Centre to “improve filing services” on war footing. Nitesh...

Post tax rate cut, FMCG firms set to reduce prices

News & FAQs | By ALOK PATNIA | Last updated on Nov 13, 2017

Prices of shampoo, chocolates, nutrition drinks and condensed milk are set to drop 5-15% after the GST Council eased these from higher ta...

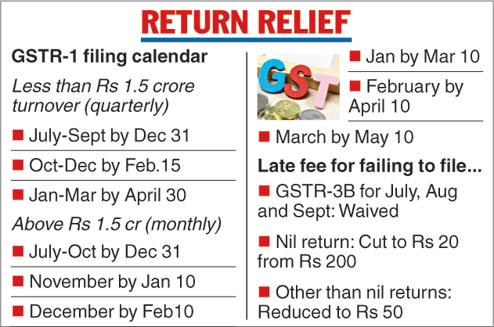

GST Compliances eased for taxpayers having upto Rs. 1.5 crore

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Last updated on Nov 11, 2017

The GST Council on Friday provided the much-needed relief to businesses by easing return filing requirements as well as lowering the pena...

Composition scheme receives huge boost after GST Council Meeting

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Last updated on Nov 11, 2017

The 23rd GST Council Meeting was held yesterday, on 10th November 2017. The meeting had some huge perks to offer – much needed ones...

GST Council raises composition scheme threshold to Rs 2 crore

News & FAQs | By ALOK PATNIA | Last updated on Nov 10, 2017

1. The Goods and Services Tax (GST) Council today decided to slash rates on more than 175 items, reducing taxes on these from the existin...

Here’s what could become cheaper after GST Council’s meet today

News & FAQs | By ALOK PATNIA | Last updated on Nov 10, 2017

The GST Council may today consider reducing items in the 28 per cent tax slab and slash rates for daily use items, plastic products and h...

Centre likely to announce procedure to address GST-related issues promptly

News & FAQs | By ALOK PATNIA | Last updated on Nov 10, 2017

The government is looking to announce a procedure wherein the GST Council can address issues related to the indirect tax regime either su...

Toll Free:

Toll Free:  Contact Us

Contact Us