The Income Tax Department has provided us the facility to view tax credit statement (i.e. details of all the tax credited) online known as Form 26AS. IT Department has also guided us to check tax credit t before filing Income Tax Returns. But, Tax Credit Statement can only be verified with respect to FY 2005-06 onwards.

The Income Tax Department has provided us the facility to view tax credit statement (i.e. details of all the tax credited) online known as Form 26AS. IT Department has also guided us to check tax credit t before filing Income Tax Returns. But, Tax Credit Statement can only be verified with respect to FY 2005-06 onwards.

Form 26AS Form 26AS is Annual Tax Statementcontaining details of all the taxes credited in the name of the assessee. The form is available in the Income Tax Department website & is updated regularly by them. Form 26AS contains the details of:

- Tax Deducted at Source(TDS)

- Tax Collected at Source(TCS)

- Payment of Advance Tax, Self Assessment Tax & Regular Assessment Tax.

- Payment of refund during the financial year.

- High value transactions in respect of shares, mutual funds etc.

You might also check out: Understanding all about TDS

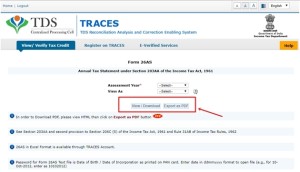

Steps to view Form 26AS

- Log in to Income Tax department website (www.incometaxindia.gov.in) & get yourself registered there.

- After getting registered, log in to the user ID.

- Click on My Account tab.

- You will see option of View Tax Credit Statement.

- Then click on Form 26AS.

- The new screen will appear where you have to select Assessment year.

- Enter your date of birth & capcha code in order to view the statement.

- Then, it will redirect you to the NSDL site where you have to press the confirm button.

- You will be re-directed to your Form 26AS.

- Please remember that Assessment year is one year ahead of the financial year. For example for FY 19-20, the assessment year is 20-21.

If you need help with your TDS payments, return filing or any other ancillary issue, you can reach out to us at Tax and Legal Compliance Retainer.

_____________________________________________________________________________________________________________________________________

Taxmantra Global assists 40K+ businesses globally with their tax and regulatory compliance.

Reach us at https://taxmantra.com/compliance-retainer-india or call us at 1800-102-7550 for any support/query/feedback.

_____________________________________________________________________________________________________________________________

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us