What is Goods And Service Tax?

As the name suggests, it is a tax levied when a consumer buys a good or service. It is meant to be a single, comprehensive tax that will subsume all the other smaller indirect taxes on consumption like service tax, etc. This is how it is done in most developed countries.

Need of the Hour

India’s biggest indirect tax reform since 1947 looks like it has finally arrived – the Goods and Service Tax. From its first official mention in 2009 when a discussion paper was introduced by the previous government to the point when the current government tabled the Constitution Amendment Bill in Parliament, building consensus on the GST hasn’t been easy.

Facts about GST

- Officially, the Constitution (One Hundred and Twenty-Second Amendment) Bill 2014.

- It was introduced in the Lok Sabha on December 19, 2014 by Finance Minister Arun Jaitley.

- The Bill seeks to shift the restriction on States for taxing the sale or purchase of goods to the supply of goods or services.

- The Bill seeks to amend the Constitution to introduce a goods and services tax (GST) which will subsumes various Central indirect taxes, including the Central Excise Duty, Countervailing Duty, Service Tax, etc. It also subsumes State value added tax (VAT), octroi and entry tax, luxury tax, etc.

- The GST Council will be the body that decides which taxes levied by the Centre, States and local bodies will go into the GST; which goods and services will be subjected to GST; and the basis and the rates at which GST will be applied.

- Parliament can decide on compensating States for up to a five-year period if States incur losses by implementation of GST

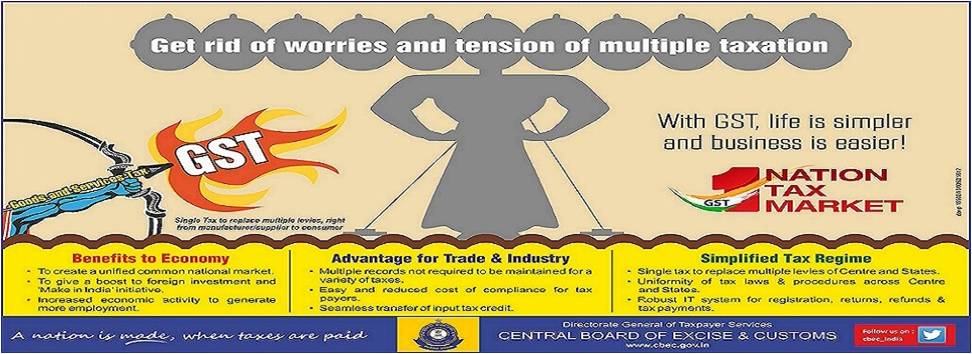

Why GST?

1. Simplification of indirect tax

The multiplicity of indirect tax has caused numerous compliance woes. The introduction of GST will largely simplify the compliance and remove multiple taxes. It will bring uniformity in taxes.

2. ‘One country, one tax’

As there will be only one indirect tax framework, it will help transform the economy by encouraging transparency and thereby facilitating ‘one country, one tax’ concept.

3. Single Economic ZONE

GST forges a single economic zone for the country from overlapping federal and state taxes. GST is in line with Cooperative Federalism wherein the centre and the states work together for the benefit of the nation.

4. Boost in Foreign investment

In the longer run, the GST is expected to attract foreign investment reducing the cost of capital goods; raise manufacturing and exports, increase tax collections and create jobs.

5. End of ‘Tax Terrorism

Many cases of tax evasion have led to a situation of tax terrorism in the country. Hence It is expected that GST will put an end to “Tax Terrorism” because of stricter rules.

6. “Make In India” will get a boost

Manufacturing will get more competitive as GST addresses the issue of cascading tax, inter-state tax, high logistics cost and fragmented market.

7. For ease of starting business

Today, a business having operations across different state needs VAT registration. Different tax rules in different states only add to the complications and incur high procedural fees.

GST will bring in unification and will make starting a business easier and the consequent expansion easy.

8. Simple Taxation

GST will simply the process by integrating all taxes, making the process of paying tax simpler. Also double taxation will be avoided. In present regime, Central Taxes are not recognized by state and state taxes are not recognized by Central.

9. Respite for business in both sales and services

Businesses like restaurants which fall under both Sales and Service taxation, have to calculate both VAT and Service Tax separately. GST will not distinguish between sales and services and GST will be applicable on total.

10. Reduction in logistics cost and time across state

Many transport vehicles got delayed during movement across states due to small tax borders and check post issues. Interstate movement will become cheaper and less time consuming as these taxes will be eliminated.

11. Protection from increased imports

GST will address the issue of increased imports by levying an appropriate countervailing duty on imports.

12. Boost to e-commerce industry

State and central taxes have levied multiple taxes on e-commerce thereby making the sector more complicated. Some sellers are discouraged from selling because of such complications. GST ‘frees up’ the e-commerce sector.

13. For GDP growth

It is expected that implementation of GST would lead to 2% incremental GDP growth.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us