Do you feel you have done your bit for the first few years of your business and now is the time when the platform is laid and you just need to take off and scale your business to new heights?

Are accounting, taxation, company law, PF, ESI and other statutory compliance stopping you from doing your business?

Every Company irrespective of its quantum of revenue earned, need to do certain regulatory compliance for a financial year.

These compliance are not only extensive but they can adversely impact your business if it is not taken care of. Non-compliance not only lead to imposition of huge interests and penalties, they may even land you in prison.

There are two ways, these can be taken care of, one is the traditional way, where you hire an accounts team on your payroll and deal with ever rising cost and attrition of human resources. Moreover, there is severe dearth of quality accountants in the market. If the quality is compromised, the so called vendor/accountant may screw things up rather doing any good and may transport you in the world of interests, penalties and even imprisonment.

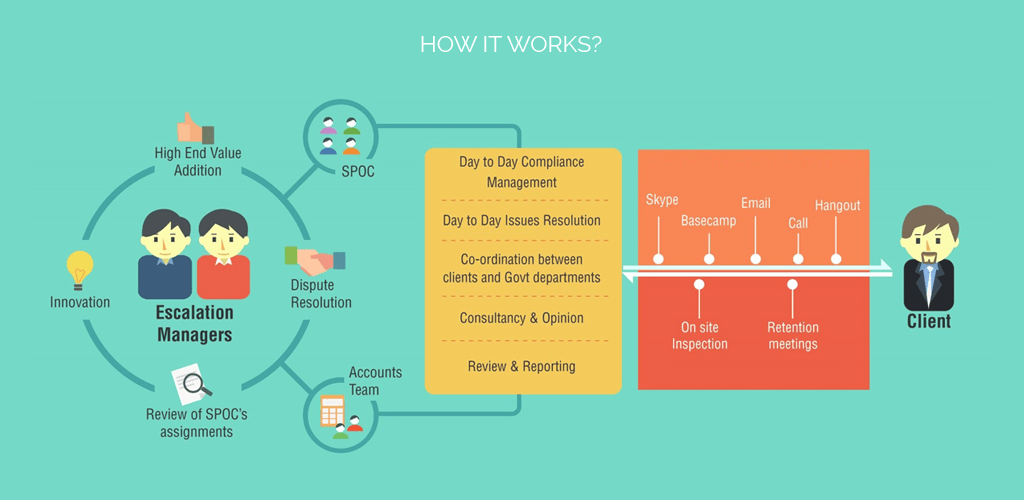

The other way is the TAXMANTRA way: Taxmantra will assign you a SINGLE POINT OF CONTACT, who shall co-ordinate between you and your representatives and amongst different expert teams at Taxmantra.

Taxmantra has a team of trained accountants working under the supervision of Qualified Chartered Accountants, providing excellent accuracy and efficiency in accounting, payroll processing, taxes and other statutory compliances. This SPCshall work remotely online, based upon the details uploaded by your company to our online platform by you.

Over and above this taxmantra would charge from you a fee even less than half of the fee charged by traditional accountants from you (Based upon the quantum of transactions in your business), with added advantages of:

- Expert advice on the accounting process (Under Supervision of an Expert, Chartered Accountant);

- 30+ years of core area specialisation

- Cross-over expertise with expert insights in global tax and legal arena

- All services under one roof;

- No need to visit consultants office as work is handled remotely and most of the issues are resolved either online or through phone/video calls;

- Cost effective as compared to the traditional way;

- Global presence in UK,US,India,Singapore, Middle east,Europe,Australia & New Zealand

Some of the compliance which every business has to undergo on monthly, quarterly and annual basis and the costs involved, if the traditional way is chosen are as follows:

1. BOOK KEEPING AND PAYROLL PROCESSING:

- Maintenance of books of accounts- As per the law, every business entity needs to prepare and maintain proper books of accounts, incorporating all expenses and revenue generated for each financial year (April to March) and accounting for assets and liabilities. This includes punching of all financial data in an accounting software preparation of profit and loss statements, Balance Sheet, Day Books, statutory registers and Finalization of Accounts for audit.

- Monthly Payroll Processing – This includes Computing the monthly remuneration payable to each director, Computing the monthly remuneration payable to each employee, Computing the loss of pay for each employee on monthly basis in strict adherence to the HR policies followed in the company, Computing the credit leaves accrued during the month, adjusted during the month and carried forward to the next month on monthly basis in strict adherence to the HR policies followed in the company, withholding taxes (TDS), payment of TDS and issue of required certificates in form 16.

APPROXIMATE COST INVOLVED IN TRADITIONAL METHOD – A full time accounts team with an Accounts manager and a junior accountant costing at least Rs. 25, 000/- per month or Rs. 3, 00, 000/- annually.

2.EMPLOYEES RELATED STATUTORY COMPLIANCE

- Employee Provident Fund, ESIC & Professional Taxes Monthly Payment and Return Filing – This would include the Computation of Monthly Employee’s Provident Fund Contribution, Monthly payment of Employee’s Provident Fund within 25th day of the subsequent month, Preparation and Filing of Provident Fund Monthly Return, Calculation of Employee’s Pension and Provident Fund, Generation Employee’s Provident Fund Slip, Compliances pertaining to addition of new employee in Provident Fund database, as and when the requirement arises, Compliances pertaining to removal of existing employees in Provident Fund database, as and when the requirement arises Settlement of claim of resigning employee AND Compliances pertaining to Transfer of Provident Fund Number of employees in case of switch-over and updating the Provident Fund database, as and when the requirement arises, similar is the case with Employee State Insurance and Professional Taxes compliances.

APPROXIMATE COST INVOLVED IN TRADITIONAL METHOD – A local PF, ESI, PT consultant who would charge you at least Rs. 25, 000/- annually.

3. MINISTRY OF CORPORATE AFFAIRS RELATED COMPLIANCE

All companies registered under the Companies Act, 2013 have to annually comply with the provisions of the Act:

Annual ROC Compliances – This includes filing of necessary forms by a company on annual basis with MCA, as mandated by Companies Act, 2013.

Secretarial Drafting in consonance with Secretarial Standards as introduced by Companies Act, 2013: This would capture all the necessary drafting to be undertaken throughout the year, such as:

APPROXIMATE COST INVOLVED IN TRADITIONAL METHOD – A local CA or CS will have to be hired who would charge you a minimum of Rs.

40, 000/- for this annually.

4. Filing of return of income and complying with the provisions of income tax, service tax, GST:

Every company is required to file a return of income/loss every year with the income tax department. Further, there are provisions relating to TDS, advance tax and other filings. Similarly, there are indirect taxes like Goods & Service tax levied on all services provided/goods sold by a person. There are monthly, quarterly and annual compliance of these laws, which vary from case to case.

APPROXIMATE COST INVOLVED IN TRADITIONAL METHOD – A local CA or tax consultant will have to be hired who would charge you a minimum of Rs. 30, 000/- for this annually.

5.Audits

There are provisions of statutory audit under the Companies Act, 2013 applicable to all companies and Tax Audit under the Income Tax Act, 1961, applicable to every person whose total turnover exceeds Rs. 1 Cr.

APPROXIMATE COST INVOLVED IN TRADITIONAL METHOD – A local CA will have to be hired who would charge you a minimum of Rs. 30, 000/- for this annually.

In total, this would cost you approximately Rs. 4, 00, 000/- annually if your total turnover is anywhere between 1 Cr to 5 Cr. Plus, you will have to deal with 3-4 different accountants/ consultants/professionals. Further, there can be lack of co-ordination between these different accountants/consultants. You or your representative may have to visit the offices of the traditional consultants.

In comparison, Taxmantra’s deeply customised and affordable solutions helps you in choosing your peace of mind over compliance hassles. For an understanding of our packages, please visit India Tax and Legal Compliance Retainer section.

_____________________________________________________________________________________________________________________________________

We’re listening:

Reach us at https://taxmantra.com/ or Call/WA us at +91-9230033070 for any support/query/feedback.

________________________________________________________________________________________________________________________________

Toll Free:

Toll Free:  Contact Us

Contact Us