GST is commonly described as indirect, comprehensive, broad-based consumption Tax. The Dual GST which would be implemented in India will subsume many consumption taxes. The objective is to remove the multiplicity of tax levies thereby reducing the complexity and remove the effect of Tax Cascading. The objective is to subsume all those taxes that are currently levied on the sale of goods or provision of services by either Central or State Government. The subsumption of a large number of taxes and other levies will allow free flow of a larger pool of tax credits at both Central and State level.

PRINCIPLES OF TAX SUBSUMPTION

The various Central, State and Local levies were examined to identify their possibility of being subsumed under GST. While identifying, the following principles were kept in mind:

- Taxes or levies to be subsumed should be primarily in the nature of indirect taxes, either on the supply of goods or on the supply of services.

- Taxes or levies to be subsumed should be part of the transaction chain which commences with import/ manufacture/ production of goods or provision of services at one end and the consumption of goods and services at the other.

- The subsumption should result in a free flow of tax credit in intra and inter-State levels.

- The taxes, levies and fees that are not specifically related to supply of goods & services should not be subsumed under GST.

- Revenue fairness for both the Union and the states individually would need to be attempted.

Taxes to be subsumed in GST

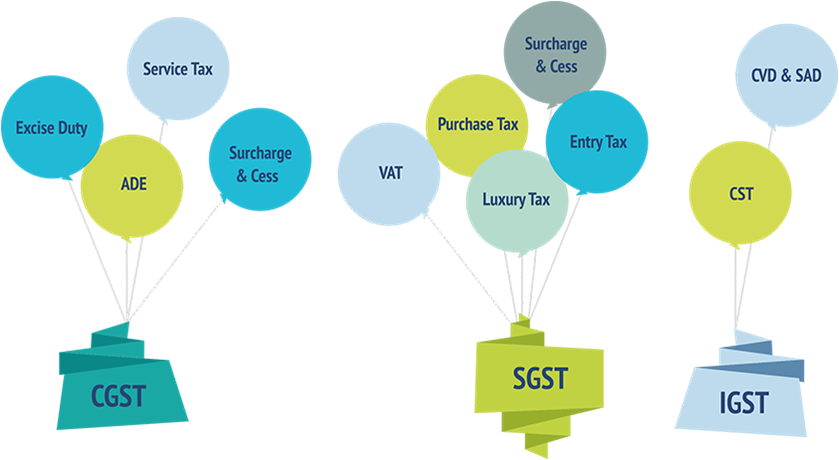

CENTRAL TAXES TO BE SUBSUMED IN GST

Following Central Taxes should be, to begin with, subsumed under the Goods and Services Tax:

- Central Excise Duty (CENVAT)

- Additional Excise Duties

- The Excise Duty levied under the Medicinal and Toiletries Preparations (Excise Duties) Act 1955

- Service Tax

- Additional Customs Duty, commonly known as Countervailing Duty (CVD)

STATE TAXES TO BE SUBSUMED IN GST

Following State taxes and levies would be, to begin with, subsumed under GST:

- VAT / Sales tax Entertainment tax (unless it is levied by the local bodies)

- Luxury tax Taxes on lottery, betting and gambling State Cesses and Surcharges in so far as they relate to supply of goods and services

- Octroi and Entry Tax

- Purchase Tax

TREATMENT OF SPECIFIC GOODS

The Central Government tabled the 122nd Constitution Amendment Bill, 2014 (‘Bill’) on the introduction of Goods and Services Tax (‘GST’) before the lower house of Parliament on December 19, 2014. On analysis of the Bill, the Bill contains the following treatment for the specific goods:

TAX ON SUPPLY OF THE ALCOHOLIC LIQUOR FOR HUMAN CONSUMPTION

As per the proposed amendment to Constitution by the Constitution (122nd Amendment) Bill, 2014, the supply of the alcoholic liquor for human consumption has been excluded from the definition of goods and service tax. New clause 12A has been inserted in Article 366 which defines goods and service tax as follows:

“Goods and services tax” means any tax on supply of goods or services or both except taxes on the supply of the alcoholic liquor for human consumption.

Hence, the supply of the alcoholic liquor for human consumption will be out of the GST. Alcohol products for human consumption would continue to be exclusively taxed by the States. Since the Bill specifically excludes alcohol products from the ambit of GST, bringing it within GST at a future date would require another constitutional amendment. CST on inter-state sales of alcohol would also continue. It, therefore, appears that the empowerment of States to tax alcohol products is intended to remain unaltered in the near future.

If you need help with your GST payments, return filing or any other ancillary issue, you can reach out to us at Tax and Legal Compliance Retainer.

TAX ON TOBACCO PRODUCTS

Tobacco and tobacco products would be subjected to GST. However, it can be subjected to a separate excise duty by the Centre.

TAX ON PETROLEUM CRUDE/ HIGH SPEED DIESEL/ MOTOR SPIRIT/ NATURAL GAS/ AVIATION TURBINE FUEL

The States would continue as per the current laws to impose Value Added Tax (VAT) on Petroleum Crude/ High-Speed Diesel/ Motor Spirit/ Natural Gas/ Aviation Turbine Fuel on intra-state sales while inter-state sales would continue to attract Central Sales Tax (CST). These products would be transitioned into the GST regime from a future date to be notified by the GST Council.

It is currently unclear from the schematics of the Bill whether States would fully discontinue collecting VAT/ CST on these products from this notified date, or whether the transition would be gradual. The Bill however also states that these products can be subjected to an excise duty imposed by the Centre; this levy would be imposed now and even after GST comes into force. Such duty can be in addition to the applicable VAT or GST imposed.

TAX ON NEWSPAPERS AND ADVERTISEMENT THEREIN

GST would be capable of being levied on the sale of newspapers and advertisements therein. This would give the governments the access to substantial incremental revenues since this industry has historically been tax free in its entirety.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

TAXES WHICH ARE NOT SUBSUMED

GST may not subsume the following taxes within its ambit:

- Basic Customs Duty: These are protective duties levied at the time of Import of goods into India.

- Exports Duty: This duty is imposed at the time of export of certain goods which are not available in India in abundance.

- Road & Passenger Tax: These are in the nature of fees and not in the nature of taxes on goods and services.

- Toll Tax: These are in the nature of user fees and not in the nature of taxes on goods and services.

- Property Tax

- Stamp Duty

- Electricity Duty

_____________________________________________________________________________________________________________________________________

Taxmantra Global assists 40K+ businesses globally with their tax and regulatory compliance.

Reach us at https://taxmantra.com/compliance-retainer-india or call us at 1800-102-7550 for any support/query/feedback.

_____________________________________________________________________________________________________________________________

Toll Free:

Toll Free:  Contact Us

Contact Us