Blogs

VALUATION UNDER GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Valuations under the GST law refers to ‘value of taxable supply’ Determination of Value of taxable supply is of utmost...

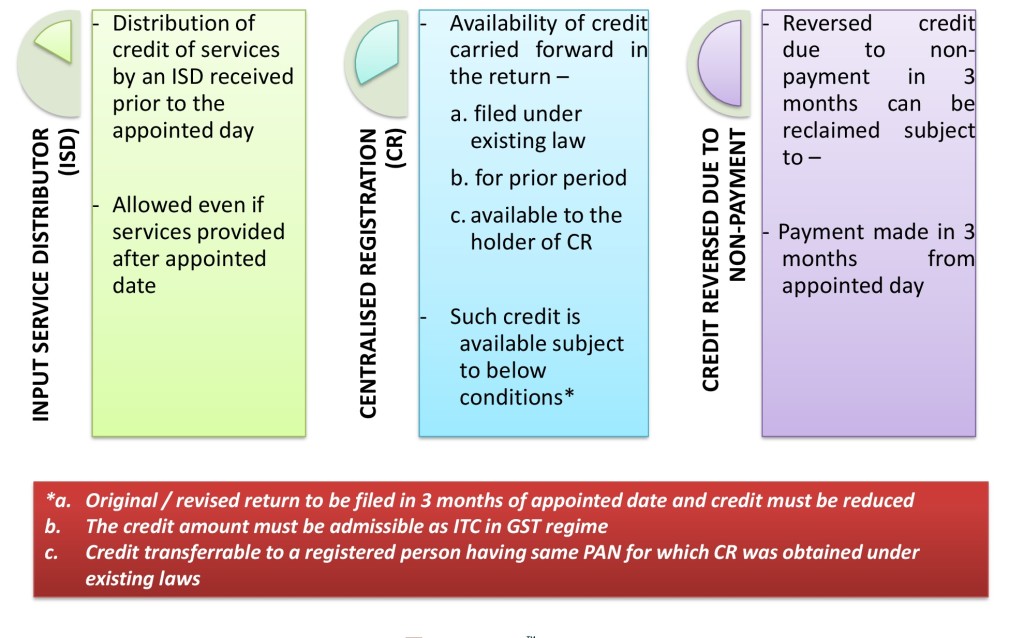

TRANSITIONAL PROVISIONS UNDER GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

MIGRATION OF EXISTING TAXPAYERS IN GST A certificate of registration on a provisional basis is first issued to every person registered un...

Import and Export under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

The current Indirect tax regime in India is complex as there are multiplicity of taxes, elaborate compliance obligations and tax cascadin...

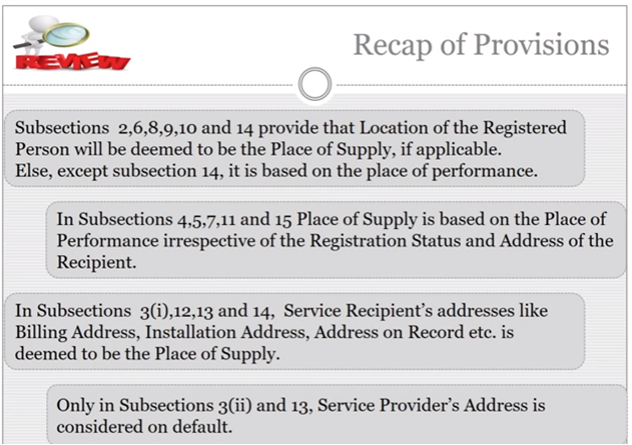

Place of supply of goods & services under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

This content would basically cover the following topics: Relevance of place of supply Rules for determining place of supply of goods Rul...

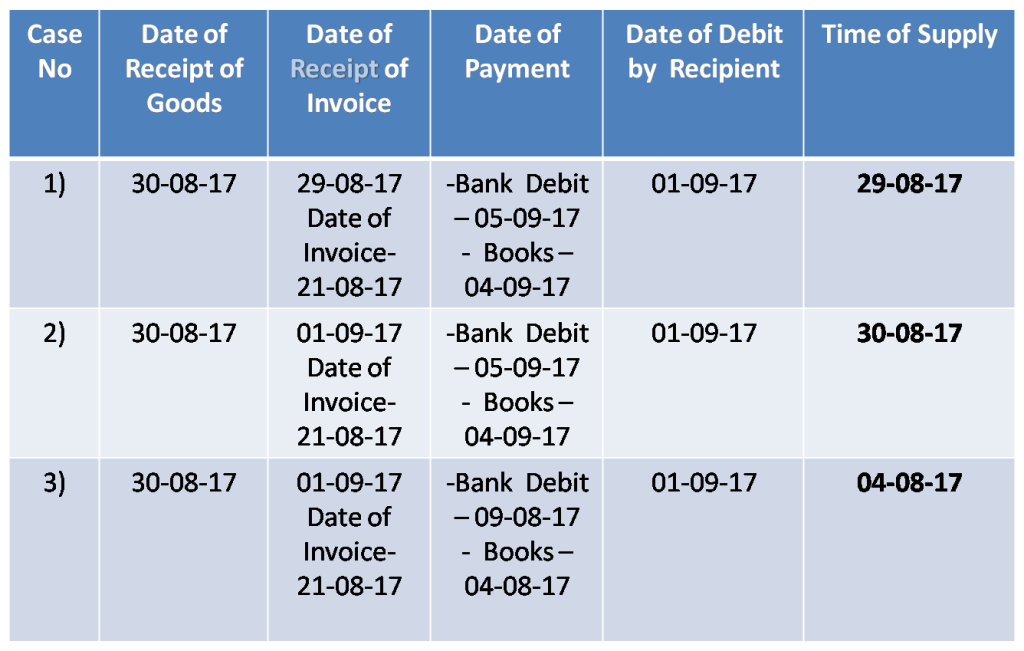

Time of supply of goods & services under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

TIME OF SUPPLY OF GOODS (1) The liability to pay GST on the goods shall arise at the time of supply as determined in terms of the provis...

Meaning of Supply of goods and Supply of Services under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Definition of Supply under GST Definition of ‘supply’ Under section 2(92) read with section 3 ‘supply’ includes all forms of supply o...

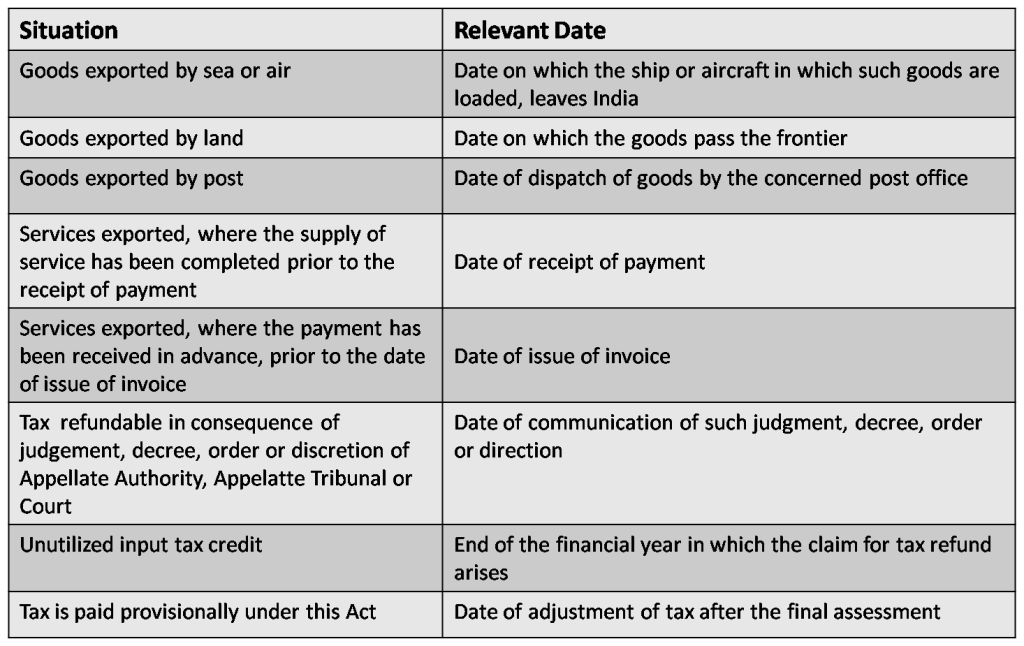

How to get refunds in the Goods & Service Tax (GST) regime?

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

WHAT IS REFUND UNDER GST? Refund has been discussed in Section 54 of the CGST/SGST Act. “Refund” includes : (a)any balance amount in the ...

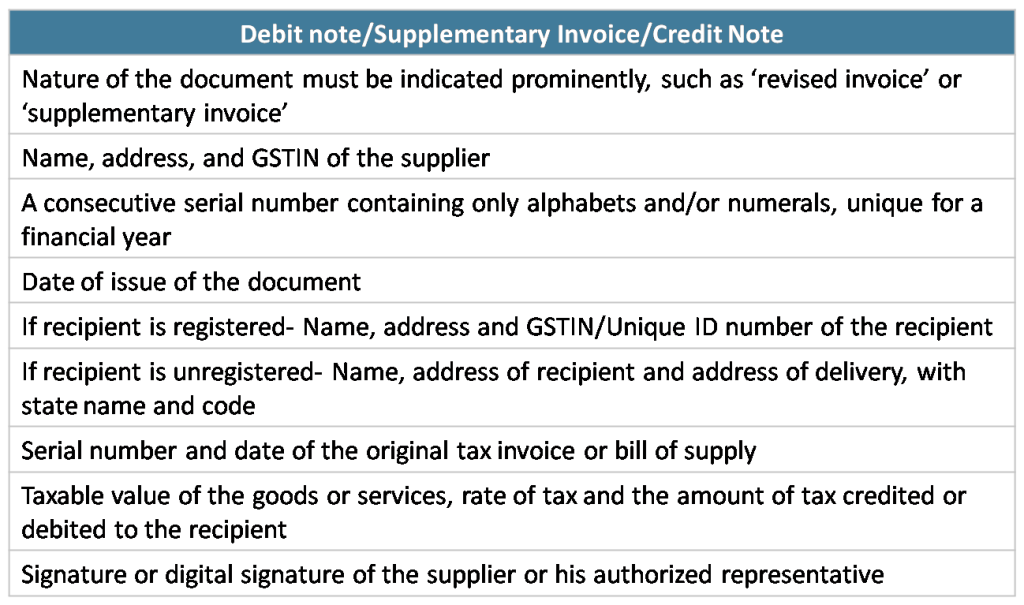

Invoicing Process under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Raising of invoices will be the most crucial part of the GST Regime. It will be the basis on which rightful inputs can be availed. The ab...

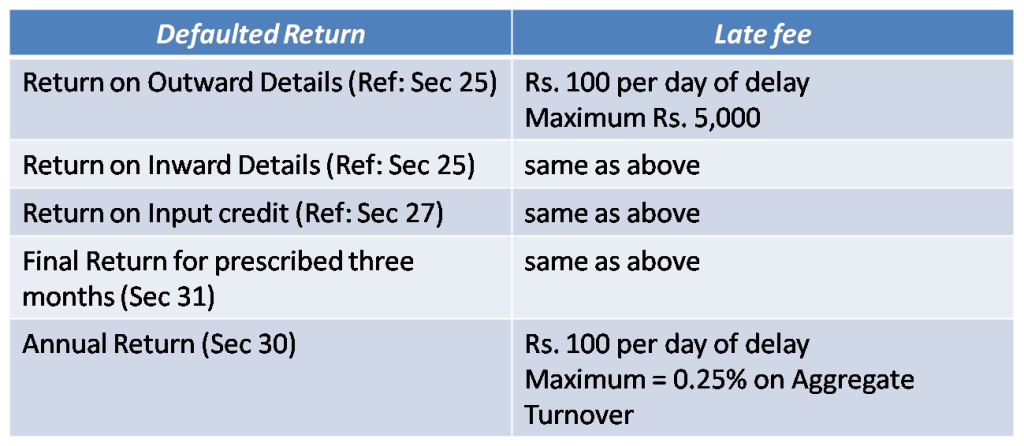

Filing of Returns under Goods and Service Tax ( GST)

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Furnishing details of outward supplies- (GSTR 1) This Return is not applicable to Input Service Distributor, Deductor of Tax (Section 37)...

Toll Free:

Toll Free:  Contact Us

Contact Us